Increasing Prevalence of Diabetes

The rising incidence of diabetes is a primary driver for the Blood Glucose Monitoring Market. According to recent statistics, the number of individuals diagnosed with diabetes continues to escalate, with projections indicating that by 2030, approximately 578 million people will be affected. This alarming trend necessitates effective blood glucose monitoring solutions to manage the condition. As diabetes becomes more prevalent, the demand for innovative monitoring devices, including continuous glucose monitors and smart meters, is likely to surge. Consequently, manufacturers are compelled to enhance their product offerings to cater to this growing population, thereby propelling the Blood Glucose Monitoring Market forward.

Government Initiatives and Support

Government initiatives aimed at combating diabetes and promoting health are pivotal in driving the Blood Glucose Monitoring Market. Various countries are implementing policies to enhance diabetes care, including subsidies for monitoring devices and funding for research and development. These initiatives not only improve access to blood glucose monitoring solutions but also encourage innovation within the industry. For example, some governments are collaborating with healthcare providers to establish programs that facilitate early diagnosis and management of diabetes. Such supportive measures are likely to stimulate growth in the Blood Glucose Monitoring Market, as they create a conducive environment for both manufacturers and consumers.

Rising Health Awareness and Preventive Care

There is a growing emphasis on health awareness and preventive care, which is significantly influencing the Blood Glucose Monitoring Market. As individuals become more informed about the risks associated with diabetes and the importance of regular monitoring, the demand for blood glucose monitoring devices is likely to increase. Educational campaigns and initiatives aimed at promoting healthy lifestyles are encouraging people to take proactive measures in managing their health. This shift towards preventive care is expected to drive the market, as more consumers seek reliable monitoring solutions to maintain optimal glucose levels and prevent complications associated with diabetes.

Technological Advancements in Monitoring Devices

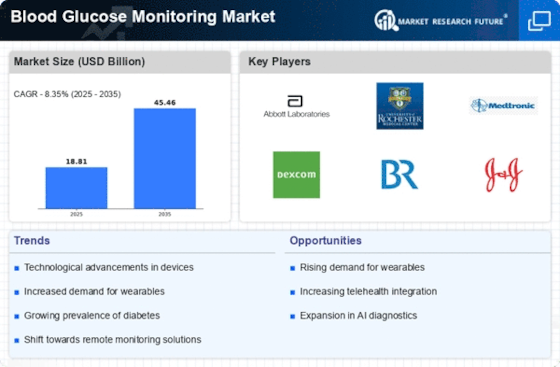

Technological innovation plays a crucial role in shaping the Blood Glucose Monitoring Market. Recent advancements, such as the development of non-invasive glucose monitoring technologies and the integration of artificial intelligence in data analysis, are transforming how patients manage their diabetes. For instance, devices that utilize optical sensors or biosensors are gaining traction, offering users more convenient and accurate monitoring options. The market is projected to witness a compound annual growth rate of around 6.5% over the next five years, driven by these technological enhancements. As a result, the Blood Glucose Monitoring Market is expected to expand significantly, attracting investments and fostering competition among key players.

Aging Population and Associated Health Challenges

The aging population presents a significant driver for the Blood Glucose Monitoring Market. As individuals age, the risk of developing diabetes and other chronic conditions increases, necessitating effective monitoring solutions. By 2030, it is estimated that the number of people aged 60 and above will reach 1.4 billion, many of whom will require regular blood glucose monitoring. This demographic shift is likely to create a substantial demand for user-friendly and efficient monitoring devices tailored to the needs of older adults. Consequently, the Blood Glucose Monitoring Market is expected to adapt and innovate to meet the unique requirements of this growing segment.