Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver for the blood coagulation-testing market. As healthcare budgets expand, there is a greater focus on preventive care and early diagnosis, which includes coagulation testing. The US spends approximately $4 trillion annually on healthcare, with a substantial portion allocated to diagnostic services. This financial commitment is likely to enhance the availability and accessibility of coagulation tests across various healthcare settings. Additionally, as insurance coverage for diagnostic tests improves, more patients are expected to seek coagulation testing services. Consequently, the blood coagulation-testing market is anticipated to benefit from this upward trend in healthcare spending.

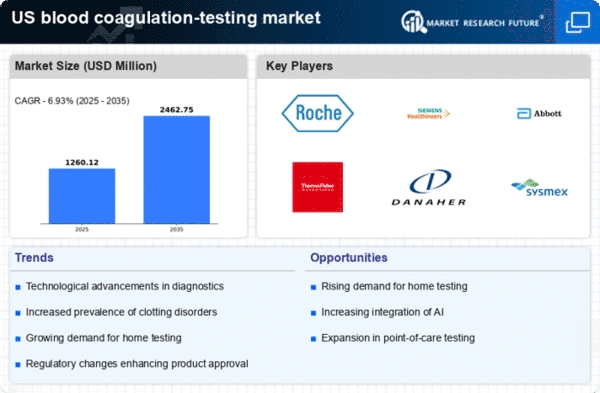

Advancements in Diagnostic Technologies

Technological innovations in diagnostic tools are significantly influencing the blood coagulation-testing market. The introduction of point-of-care testing devices and automated laboratory systems enhances the speed and accuracy of coagulation tests. For instance, the development of portable devices allows for immediate testing in various settings, including emergency rooms and outpatient clinics. This shift towards rapid testing solutions is likely to improve patient outcomes and streamline clinical workflows. Moreover, advancements in molecular diagnostics and biosensors are expected to provide more precise results, further driving market growth. As healthcare providers increasingly adopt these technologies, the blood coagulation-testing market is poised for substantial expansion.

Growing Demand for Home Testing Solutions

The trend towards home healthcare is reshaping the blood coagulation-testing market. Patients with chronic conditions, such as atrial fibrillation or those on anticoagulant therapy, are increasingly seeking home testing options for convenience and better management of their health. The availability of user-friendly devices that allow patients to perform tests at home is likely to enhance adherence to treatment protocols. This shift not only empowers patients but also reduces the burden on healthcare facilities. Market data suggests that the home healthcare segment is expected to grow at a CAGR of over 10% in the coming years. As more patients opt for home testing, the blood coagulation-testing market will likely experience a significant boost.

Increasing Incidence of Coagulation Disorders

The rising incidence of coagulation disorders in the US is a primary driver for the blood coagulation-testing market. Conditions such as hemophilia, thrombosis, and other clotting disorders are becoming more prevalent, necessitating accurate and timely testing. According to recent estimates, approximately 400,000 individuals in the US are affected by hemophilia alone. This growing patient population is likely to increase the demand for coagulation tests, as healthcare providers seek to monitor and manage these conditions effectively. Furthermore, the aging population is also contributing to this trend, as older adults are more susceptible to clotting disorders. Consequently, the blood coagulation-testing market is expected to expand as healthcare systems adapt to these rising needs.

Regulatory Support for Innovative Testing Methods

Regulatory bodies in the US are increasingly supporting the development and approval of innovative testing methods in the blood coagulation-testing market. Initiatives aimed at expediting the review process for new diagnostic tools are encouraging manufacturers to invest in research and development. The FDA's commitment to facilitating the introduction of novel technologies is likely to enhance competition and drive innovation within the market. As new products enter the market, healthcare providers will have access to a broader range of testing options, potentially improving patient care. This regulatory environment is expected to foster growth in the blood coagulation-testing market as companies strive to meet evolving healthcare needs.