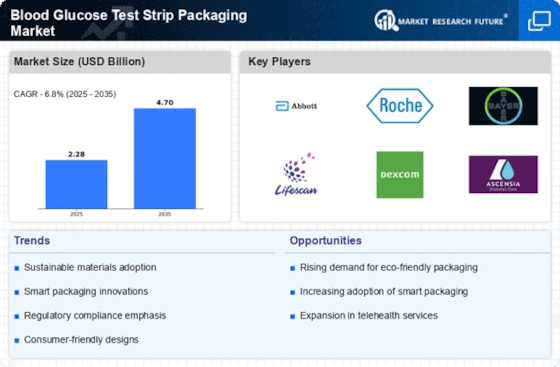

Rising Diabetes Prevalence

The increasing prevalence of diabetes worldwide is a primary driver for the Blood Glucose Test Strip Packaging Market. According to recent statistics, the number of individuals diagnosed with diabetes has surged, with estimates suggesting that over 500 million people are currently living with the condition. This rise in diabetes cases necessitates the demand for effective monitoring solutions, including blood glucose test strips. As more patients require regular monitoring to manage their condition, the packaging of these test strips becomes crucial. Enhanced packaging not only ensures the integrity and usability of the strips but also plays a vital role in patient adherence to testing regimens. Consequently, the Blood Glucose Test Strip Packaging Market is likely to experience substantial growth as manufacturers respond to this increasing demand.

Consumer Demand for Convenience

The growing consumer demand for convenience and ease of use is a notable driver in the Blood Glucose Test Strip Packaging Market. Patients increasingly prefer packaging that simplifies the testing process, making it more accessible for daily use. Features such as single-use packaging and easy-to-open designs cater to the needs of individuals managing diabetes. Additionally, the rise of telehealth and remote monitoring solutions has further emphasized the need for user-friendly packaging that can be easily integrated into patients' lifestyles. As manufacturers respond to these consumer preferences, the Blood Glucose Test Strip Packaging Market is likely to see a shift towards more innovative and convenient packaging solutions that enhance the overall user experience.

Sustainability Trends in Packaging

Sustainability trends are emerging as a significant driver in the Blood Glucose Test Strip Packaging Market. With increasing awareness of environmental issues, consumers and manufacturers alike are seeking eco-friendly packaging solutions. This shift is prompting companies to explore biodegradable materials and recyclable packaging options that minimize environmental impact. For instance, some manufacturers are investing in sustainable sourcing of materials and reducing plastic usage in their packaging designs. As sustainability becomes a priority for consumers, the Blood Glucose Test Strip Packaging Market is likely to adapt, with companies that prioritize eco-friendly practices gaining a competitive edge. This trend not only aligns with consumer values but also reflects a broader commitment to corporate social responsibility within the healthcare sector.

Regulatory Standards and Compliance

The Blood Glucose Test Strip Packaging Market is significantly shaped by stringent regulatory standards and compliance requirements. Regulatory bodies across various regions enforce guidelines to ensure the safety and efficacy of medical devices, including blood glucose test strips. Compliance with these regulations is essential for manufacturers to gain market access and maintain consumer trust. For example, the FDA in the United States mandates specific packaging requirements to prevent contamination and ensure product integrity. As a result, companies are investing in high-quality packaging solutions that meet these regulatory standards. This focus on compliance not only enhances product safety but also drives innovation within the Blood Glucose Test Strip Packaging Market, as manufacturers seek to differentiate their products in a competitive landscape.

Technological Innovations in Packaging

Technological advancements in packaging materials and designs are significantly influencing the Blood Glucose Test Strip Packaging Market. Innovations such as moisture-resistant packaging and user-friendly designs enhance the functionality and shelf life of test strips. For instance, the introduction of smart packaging solutions that incorporate sensors to monitor environmental conditions can improve the reliability of test results. Furthermore, advancements in printing technology allow for clearer labeling and instructions, which can aid users in proper testing procedures. As manufacturers adopt these technologies, the Blood Glucose Test Strip Packaging Market is expected to evolve, catering to the needs of both healthcare providers and patients. This trend indicates a shift towards more sophisticated packaging solutions that align with the growing demand for accuracy and convenience in diabetes management.