Focus on Operational Efficiency

A pronounced focus on operational efficiency is driving the Upstream Oil and Gas Analytics Market. Companies are under constant pressure to reduce costs while maximizing output, leading to a heightened emphasis on analytics to streamline operations. By employing advanced analytics, organizations can identify inefficiencies in their processes and implement corrective measures. This focus is reflected in the increasing investment in analytics technologies, with projections suggesting that spending in this area could reach several billion dollars by 2026. Enhanced operational efficiency not only contributes to cost savings but also improves safety and compliance with environmental regulations. As the industry evolves, the ability to leverage analytics for operational improvements will likely become a key differentiator among market players.

Adoption of Cloud-Based Solutions

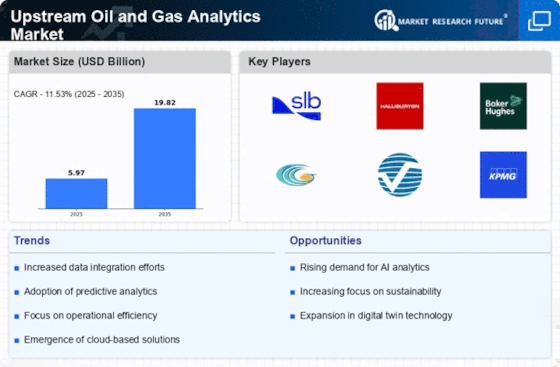

The adoption of cloud-based solutions is reshaping the Upstream Oil and Gas Analytics Market. These solutions offer scalable and flexible data storage options, enabling companies to manage large volumes of data efficiently. The cloud facilitates real-time data access and collaboration among teams, which is essential for timely decision-making. Recent reports indicate that the cloud analytics market in the oil and gas sector is expected to grow at a compound annual growth rate of over 25% in the coming years. This growth is attributed to the increasing need for cost-effective data management solutions and the ability to leverage advanced analytics tools without significant upfront investments. As more companies transition to cloud-based platforms, the potential for enhanced operational agility and innovation in analytics applications becomes apparent.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the Upstream Oil and Gas Analytics Market is transforming operational efficiencies. AI algorithms can analyze vast datasets, enabling predictive maintenance and optimizing drilling operations. This technology is projected to enhance decision-making processes, potentially reducing operational costs by up to 20%. As companies increasingly adopt AI-driven analytics, they can better forecast production levels and manage resources. The ability to process real-time data allows for immediate adjustments in operations, which is crucial in a volatile market. Furthermore, AI's role in risk assessment and management is becoming more pronounced, as it helps identify potential hazards before they escalate. This trend indicates a shift towards more data-driven strategies in the industry, suggesting that companies leveraging AI will likely gain a competitive edge.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are becoming increasingly critical in the Upstream Oil and Gas Analytics Market. As environmental regulations tighten, companies must adopt analytics solutions to ensure compliance and mitigate risks associated with exploration and production activities. The use of analytics can help organizations monitor their operations in real-time, ensuring adherence to regulatory standards and reducing the likelihood of costly penalties. Recent data suggests that companies investing in compliance analytics can reduce their risk exposure by up to 30%. This trend indicates a growing recognition of the importance of integrating compliance into business strategies, suggesting that firms that prioritize risk management through analytics will likely enhance their reputation and operational stability.

Increased Demand for Data-Driven Decision Making

The Upstream Oil and Gas Analytics Market is witnessing a surge in demand for data-driven decision-making processes. Companies are increasingly recognizing the value of analytics in enhancing operational efficiency and profitability. According to recent estimates, organizations that utilize advanced analytics can achieve up to a 15% increase in production efficiency. This demand is driven by the need to optimize resource allocation and improve exploration success rates. As the industry faces fluctuating oil prices, the ability to make informed decisions based on comprehensive data analysis becomes paramount. Moreover, the integration of analytics into everyday operations allows for better risk management and compliance with regulatory standards. This trend suggests that companies prioritizing data analytics are likely to outperform their competitors in the long run.