Rising Energy Demand

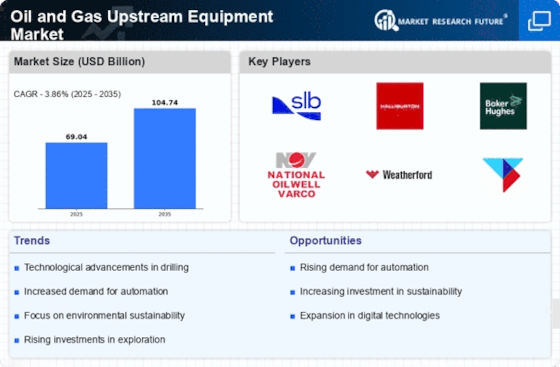

The increasing The Oil and Gas Upstream Equipment Industry. As economies expand and populations grow, the need for energy sources intensifies. According to recent estimates, energy consumption is projected to rise by approximately 30% by 2040. This surge necessitates enhanced exploration and production capabilities, thereby driving investments in upstream equipment. Companies are compelled to adopt advanced technologies to optimize extraction processes and improve efficiency. The Oil and Gas Upstream Equipment Market is likely to benefit from this trend, as operators seek to meet the escalating energy requirements while ensuring operational efficiency.

Technological Innovations

Technological innovations are transforming the Oil and Gas Upstream Equipment Market. The advent of advanced drilling techniques, such as horizontal drilling and hydraulic fracturing, has revolutionized extraction processes. These innovations enable operators to access previously unreachable reserves, thereby increasing production efficiency. In 2025, it is projected that investments in technology will constitute a substantial share of the overall market, as companies seek to enhance their operational capabilities. The Oil and Gas Upstream Equipment Market is poised for growth as operators adopt these cutting-edge technologies to optimize their extraction processes and reduce operational costs.

Investment in Exploration Activities

Investment in exploration activities remains a crucial driver for the Oil and Gas Upstream Equipment Market. With the discovery of new reserves becoming increasingly challenging, companies are allocating substantial resources to explore untapped regions. In 2025, exploration budgets are expected to increase by around 10% compared to previous years, reflecting a renewed focus on finding new oil and gas reserves. This trend is likely to stimulate demand for advanced drilling and extraction equipment, as operators strive to enhance their capabilities. The Oil and Gas Upstream Equipment Market stands to gain from this influx of investment, as companies seek to leverage cutting-edge technologies to maximize their exploration efforts.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are pivotal in shaping the Oil and Gas Upstream Equipment Market. Governments worldwide are implementing stringent regulations to ensure safe and environmentally responsible operations. This regulatory landscape compels companies to invest in advanced equipment that meets these standards. In 2025, it is anticipated that compliance-related expenditures will account for a significant portion of operational budgets, driving demand for specialized equipment. The Oil and Gas Upstream Equipment Market is likely to see growth as companies prioritize safety and compliance, leading to increased investments in innovative technologies that enhance operational safety and environmental protection.

Focus on Sustainability and Environmental Responsibility

The focus on sustainability and environmental responsibility is increasingly influencing the Oil and Gas Upstream Equipment Market. As stakeholders demand more environmentally friendly practices, companies are compelled to adopt sustainable technologies and equipment. In 2025, it is expected that investments in sustainable practices will rise significantly, with many operators seeking to reduce their carbon footprint. This shift towards sustainability is likely to drive demand for innovative equipment that minimizes environmental impact. The Oil and Gas Upstream Equipment Market may experience growth as companies align their operations with sustainability goals, thereby enhancing their competitive advantage in a rapidly evolving market.