Increasing Demand for Energy

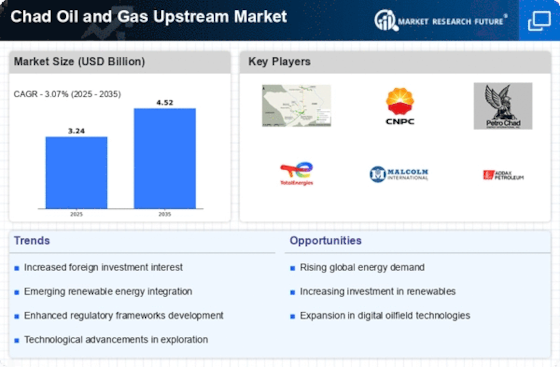

The Global Chad Oil and Gas Upstream Market Industry is experiencing a notable surge in energy demand, driven by population growth and industrialization. As countries strive to meet their energy needs, Chad's oil and gas resources become increasingly vital. The market is projected to reach 3.24 USD Billion in 2024, reflecting the growing reliance on fossil fuels. This demand is further fueled by the global transition towards energy security, where Chad's strategic location and resources play a crucial role in supplying energy to neighboring regions. The increasing need for energy diversification enhances Chad's position in the global energy landscape.

Global Energy Transition Trends

The Global Chad Oil and Gas Upstream Market Industry is influenced by the broader trends of energy transition and sustainability. While there is a global push towards renewable energy sources, oil and gas remain essential components of the energy mix. Chad's ability to adapt to these trends while optimizing its fossil fuel resources is crucial. The market's growth, projected at 3.24 USD Billion in 2024, indicates that despite the shift towards renewables, oil and gas will continue to play a significant role in meeting energy demands. This dual focus on traditional and renewable energy sources may position Chad favorably in the evolving global energy landscape.

Investment in Infrastructure Development

Infrastructure development is a critical driver for the Global Chad Oil and Gas Upstream Market Industry. The government of Chad has initiated several projects aimed at enhancing transportation and refining capabilities. Investments in pipelines, roads, and refineries are expected to facilitate smoother operations and attract foreign investment. This infrastructure expansion is likely to support the anticipated growth of the market, projected to reach 4.55 USD Billion by 2035. Improved infrastructure not only enhances operational efficiency but also positions Chad as a key player in the regional energy supply chain, potentially increasing its competitiveness in the global market.

Technological Advancements in Exploration

Technological advancements are reshaping the Global Chad Oil and Gas Upstream Market Industry, enabling more efficient exploration and extraction processes. Innovations in drilling techniques and seismic imaging are enhancing the ability to locate and extract oil and gas reserves. These advancements may lead to increased production rates and reduced operational costs, making Chad's resources more accessible. As the industry evolves, the adoption of cutting-edge technologies could significantly impact the market's growth trajectory, contributing to a projected CAGR of 3.14% from 2025 to 2035. This technological shift positions Chad to better compete in the global energy market.

Government Policies and Regulatory Framework

The regulatory environment in Chad plays a pivotal role in shaping the Global Chad Oil and Gas Upstream Market Industry. The government has implemented policies aimed at attracting foreign investment while ensuring sustainable resource management. By establishing a clear regulatory framework, Chad seeks to create a conducive environment for exploration and production activities. These policies may enhance investor confidence, leading to increased capital inflow and market growth. As the industry evolves, the government's commitment to transparency and sustainability could further strengthen Chad's position in the global oil and gas sector.

Leave a Comment