Regulatory Support and Compliance

Regulatory frameworks play a crucial role in shaping the Upstream Bioprocessing Equipment Market. Governments and regulatory bodies are increasingly establishing guidelines that promote the use of advanced bioprocessing technologies to ensure product safety and efficacy. Compliance with these regulations often necessitates the adoption of state-of-the-art upstream bioprocessing equipment, which can meet stringent quality standards. As regulatory bodies continue to evolve their policies, the demand for equipment that adheres to these guidelines is likely to increase. This trend is particularly evident in regions where regulatory support is robust, encouraging manufacturers to invest in innovative upstream technologies. The alignment of regulatory requirements with technological advancements is expected to create a favorable environment for the growth of the upstream bioprocessing equipment market.

Rising Demand for Biopharmaceuticals

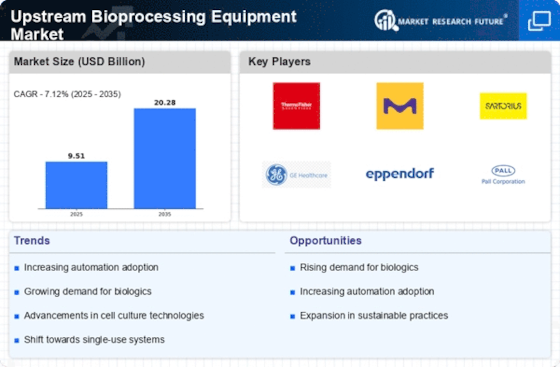

The Upstream Bioprocessing Equipment Market is experiencing a surge in demand for biopharmaceuticals, driven by the increasing prevalence of chronic diseases and the aging population. This demand is expected to propel the market as biopharmaceuticals require sophisticated upstream processing techniques for production. According to recent data, the biopharmaceutical sector is projected to grow at a compound annual growth rate of over 8% in the coming years. This growth necessitates advanced upstream bioprocessing equipment to ensure efficient production processes, thereby enhancing yield and reducing costs. As pharmaceutical companies strive to meet this rising demand, investments in innovative upstream technologies are likely to increase, further stimulating the market. The focus on biopharmaceuticals is not only reshaping production strategies but also influencing the design and functionality of upstream bioprocessing equipment.

Emerging Markets and Global Expansion

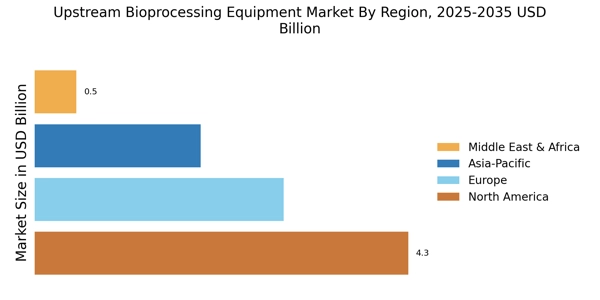

Emerging markets are becoming increasingly influential in the Upstream Bioprocessing Equipment Market. As countries in Asia, Africa, and Latin America enhance their biopharmaceutical capabilities, the demand for advanced upstream bioprocessing equipment is expected to rise. These regions are witnessing a growing number of biotechnology firms and research institutions, which are likely to require sophisticated equipment to support their production processes. Market data indicates that the biopharmaceutical market in these regions is projected to grow at a rate exceeding 10% annually. This expansion presents opportunities for equipment manufacturers to establish a presence in these burgeoning markets. The interplay between emerging market growth and the demand for advanced upstream technologies is anticipated to drive innovation and competition within the upstream bioprocessing equipment sector.

Increased Investment in Biotechnology

Investment in biotechnology is a pivotal driver for the Upstream Bioprocessing Equipment Market. As governments and private entities recognize the potential of biotechnology in addressing health and environmental challenges, funding for biotechnological research and development has escalated. Reports indicate that biotechnology investments have reached unprecedented levels, with venture capital funding in the sector exceeding billions annually. This influx of capital is likely to enhance the development of advanced upstream bioprocessing technologies, facilitating more efficient and scalable production processes. Furthermore, as biotechnology firms expand their operations, the demand for sophisticated upstream equipment is expected to rise, creating a robust market environment. The interplay between increased investment and technological advancement is anticipated to foster innovation within the upstream bioprocessing equipment sector.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is significantly influencing the Upstream Bioprocessing Equipment Market. As healthcare moves towards tailored therapies, the need for flexible and efficient bioprocessing solutions becomes paramount. Personalized medicine often requires small-scale production runs and the ability to rapidly adapt to changing patient needs, which in turn drives demand for advanced upstream bioprocessing equipment. Market analysis suggests that the personalized medicine sector is poised for substantial growth, with projections indicating a market size reaching several billion dollars in the next few years. This growth is likely to necessitate the development of innovative upstream technologies that can accommodate the unique requirements of personalized therapies. Consequently, the focus on personalized medicine is expected to be a key driver for the evolution of the upstream bioprocessing equipment market.