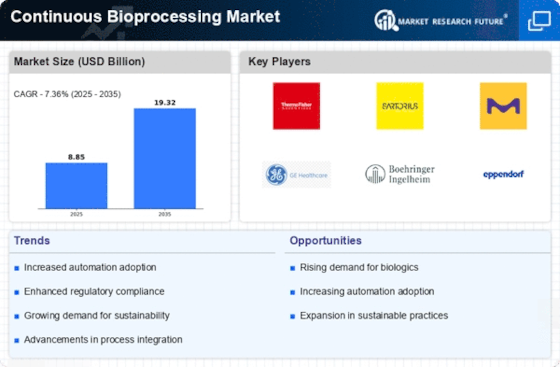

The Continuous Bioprocessing Market is currently experiencing a transformative phase, driven by advancements in technology and a growing emphasis on efficiency in biomanufacturing processes. This market appears to be evolving as companies seek to streamline production, reduce costs, and enhance product quality.

The integration of continuous processing techniques is likely to facilitate a more agile response to market demands, thereby improving overall productivity. Furthermore, the increasing focus on sustainability and environmental considerations may influence the adoption of continuous bioprocessing methods, as they often result in reduced waste and lower energy consumption.

In addition, the Continuous Bioprocessing Market seems to benefit from a collaborative approach among industry stakeholders, including academia, regulatory bodies, and technology providers. This collaboration may foster innovation and accelerate the development of new bioprocessing solutions. As the market matures, it could witness a shift towards more personalized medicine and tailored biopharmaceuticals, which may further drive the demand for continuous processing technologies.

Continuous Bioprocessing

The adoption of continuous bioprocessing is fundamentally transforming drug manufacturing by shifting the industry from discrete, time-consuming batches to a seamless, integrated flow that enhances product consistency.

Overall, the Continuous Bioprocessing Market appears poised for growth, with numerous opportunities for stakeholders to capitalize on emerging trends and technologies.

Technological Advancements

The Continuous Bioprocessing Market is witnessing rapid technological innovations that enhance process efficiency and product quality. Automation and real-time monitoring systems are becoming increasingly prevalent, allowing for better control and optimization of bioprocesses. These advancements may lead to reduced production times and improved scalability, making continuous bioprocessing more attractive to manufacturers.

Sustainability Initiatives

There is a growing emphasis on sustainability within the Continuous Bioprocessing Market, as companies strive to minimize their environmental impact. Continuous processing methods often result in lower energy consumption and reduced waste generation. This trend suggests that organizations are increasingly prioritizing eco-friendly practices, which could influence their operational strategies and investment decisions.

Collaborative Ecosystems

The Continuous Bioprocessing Market appears to be fostering collaborative ecosystems among various stakeholders, including research institutions, regulatory agencies, and technology providers. Such collaborations may facilitate knowledge sharing and innovation, leading to the development of novel bioprocessing solutions.

This trend indicates a shift towards a more integrated approach to biomanufacturing, potentially enhancing the overall efficiency of the market.