Regulatory Support and Compliance

Regulatory support plays a pivotal role in shaping the Single Use Bioprocessing Market. As regulatory bodies recognize the benefits of single-use technologies in ensuring product safety and quality, they have begun to establish guidelines that facilitate their adoption. This supportive regulatory environment encourages biopharmaceutical manufacturers to integrate single-use systems into their production processes, as compliance with regulations becomes more streamlined. Furthermore, the increasing emphasis on quality assurance and risk management in biomanufacturing aligns well with the advantages offered by single-use technologies. As regulatory frameworks continue to evolve, the Single Use Bioprocessing Market is expected to benefit from enhanced acceptance and integration of these systems within the industry.

Rising Demand for Biopharmaceuticals

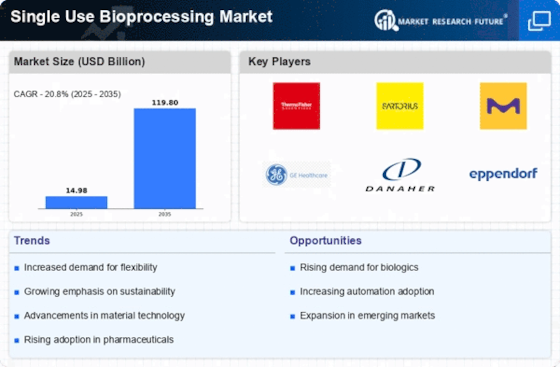

The increasing demand for biopharmaceuticals is a primary driver of the Single Use Bioprocessing Market. As the healthcare sector continues to evolve, the need for innovative therapies, particularly biologics, has surged. This trend is reflected in the projected growth of the biopharmaceutical market, which is expected to reach approximately USD 500 billion by 2025. The flexibility and efficiency offered by single-use systems align well with the rapid production requirements of biopharmaceuticals, allowing manufacturers to respond swiftly to market needs. Furthermore, the ability to minimize cross-contamination risks enhances the appeal of single-use technologies, making them a preferred choice among biopharmaceutical manufacturers. As the industry progresses, the reliance on single-use bioprocessing solutions is likely to intensify, further propelling market growth.

Advancements in Single-Use Technologies

Technological advancements in single-use bioprocessing systems are propelling the Single Use Bioprocessing Market forward. Innovations in materials and design have led to the development of more robust and reliable single-use components, enhancing their performance and safety. For instance, the introduction of advanced filtration systems and sensors has improved the efficiency of single-use bioprocessing, allowing for better monitoring and control of production processes. These advancements not only enhance product quality but also increase the overall productivity of biomanufacturing operations. As companies continue to invest in research and development to improve single-use technologies, the market is likely to witness sustained growth driven by these innovations.

Increased Focus on Personalized Medicine

The shift towards personalized medicine is significantly influencing the Single Use Bioprocessing Market. As healthcare moves towards tailored therapies that cater to individual patient needs, the demand for flexible and adaptable bioprocessing solutions has grown. Single-use systems offer the necessary scalability and customization required for the production of personalized biologics, enabling manufacturers to efficiently produce small batches tailored to specific patient profiles. This trend is underscored by the increasing number of clinical trials focused on personalized therapies, which are projected to rise significantly in the coming years. The ability of single-use technologies to accommodate these unique production requirements positions them as a vital component in the evolution of personalized medicine, thereby driving market growth.

Cost Efficiency and Reduced Time to Market

Cost efficiency remains a crucial factor driving the Single Use Bioprocessing Market. Single-use technologies significantly reduce the capital investment required for bioprocessing facilities, as they eliminate the need for extensive cleaning and validation processes associated with traditional systems. This reduction in operational costs is particularly appealing to small and medium-sized enterprises, which may lack the resources for large-scale production. Additionally, the streamlined processes enabled by single-use systems can lead to a reduced time to market for new products. The ability to quickly adapt to changing production demands without the need for extensive infrastructure changes positions single-use bioprocessing as a financially viable option. As companies seek to optimize their production capabilities, the cost benefits associated with single-use technologies are likely to drive further adoption.