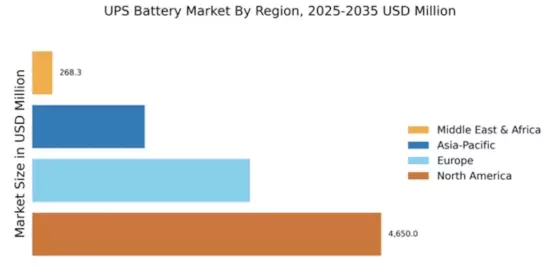

North America : Market Leader in UPS Batteries

North America is poised to maintain its leadership in the UPS battery market, with a market size of $4650.0 million in 2025. The region's growth is driven by increasing demand for reliable power solutions across various sectors, including IT, healthcare, and manufacturing. Regulatory support for energy efficiency and sustainability initiatives further catalyzes market expansion, ensuring robust growth in the coming years. The competitive landscape is characterized by major players such as Eaton, Vertiv, and Emerson Electric, which are investing heavily in innovation and technology. The U.S. leads the market, supported by a strong infrastructure and a growing focus on renewable energy sources. This competitive environment fosters advancements in UPS technology, enhancing reliability and efficiency for end-users.

Europe : Emerging Market with Growth Potential

Europe's UPS battery market is projected to grow significantly, with a market size of $2900.0 million by 2025. The region is witnessing a surge in demand for uninterrupted power supply systems, driven by increasing digitalization and the need for energy security. Regulatory frameworks promoting renewable energy and energy efficiency are key growth catalysts, encouraging investments in UPS technologies. Leading countries in this market include Germany, France, and the UK, where major players like Schneider Electric and Riello UPS are actively enhancing their product offerings. The competitive landscape is evolving, with a focus on sustainable solutions and smart technologies. As the region transitions towards greener energy, UPS systems are becoming integral to maintaining power reliability in various sectors.

Asia-Pacific : Rapid Growth in Emerging Markets

APAC UPS Battery Market is witnessing rapid growth, with a market size of 1500.0.0. This growth is fueled by increasing industrialization, urbanization, and the rising demand for uninterrupted power supply in countries like China and India.

Within this landscape, the China UPS Battery market continues to lead in manufacturing and domestic demand due to massive investments in cloud computing, while the India UPS Battery Market is emerging as a critical growth hub driven by government digitalization initiatives and industrial automation. The competitive landscape is evolving, with local manufacturers also entering the fray, driving innovation and competitive pricing. As the region continues to develop its energy infrastructure, the UPS battery market is expected to grow significantly, catering to diverse sectors from IT to healthcare.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa (MEA) UPS battery market is gradually expanding, with a market size of $268.27 million anticipated by 2025. The growth is primarily driven by increasing investments in infrastructure and the rising need for reliable power supply in sectors such as telecommunications and healthcare. Regulatory support for energy efficiency and sustainability initiatives is also fostering market development in this region. Leading countries include South Africa and the UAE, where key players like Legrand are establishing a strong presence. The competitive landscape is characterized by a mix of local and international companies, focusing on tailored solutions to meet regional demands. As the market matures, the emphasis on innovative and efficient UPS systems is expected to grow, addressing the unique challenges faced in the MEA region.