Rising Energy Needs

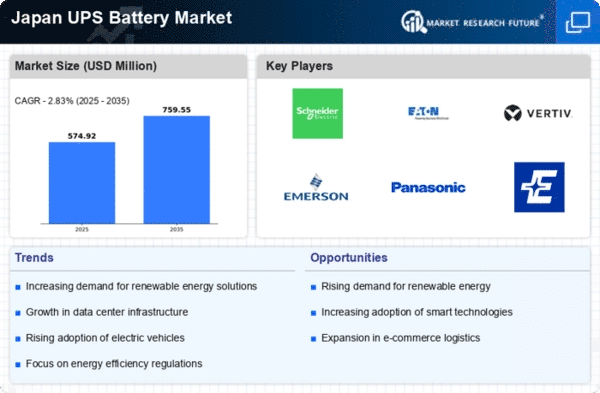

The ups battery market in Japan is experiencing growth due to the increasing energy demands across various sectors. As industries expand and urbanization accelerates, the need for reliable power sources becomes paramount. The ups battery market is projected to grow at a CAGR of approximately 6.5% over the next five years, driven by the necessity for uninterrupted power supply in critical applications such as data centers and healthcare facilities. This trend indicates a shift towards more robust energy solutions, as businesses seek to mitigate risks associated with power outages. Furthermore, the Japanese government's focus on energy efficiency and sustainability is likely to bolster investments in advanced battery technologies, further propelling the ups battery market forward.

Regulatory Support for Energy Storage

Japan's regulatory environment is increasingly supportive of energy storage solutions, which significantly impacts the ups battery market. The government has implemented various policies aimed at promoting renewable energy and energy efficiency, which creates a favorable landscape for battery technologies. For instance, subsidies and incentives for energy storage systems are becoming more common, encouraging businesses to invest in ups battery solutions. This regulatory support is expected to enhance the market's growth, as companies look to comply with new energy standards and reduce their carbon footprints. The ups battery market stands to benefit from these initiatives, as they align with the broader goals of energy transition and sustainability.

Increased Focus on Disaster Preparedness

Japan's geographical vulnerability to natural disasters has led to a heightened focus on disaster preparedness, which directly impacts the ups battery market. The need for reliable backup power systems is critical in ensuring that essential services remain operational during emergencies. The ups battery market is likely to see increased investments from both public and private sectors aimed at enhancing resilience against power outages caused by earthquakes, typhoons, and other disasters. This focus on preparedness not only drives demand for ups systems but also encourages innovation in battery technology to create more durable and efficient solutions. As a result, the ups battery market is expected to grow as stakeholders prioritize energy security in their disaster management strategies.

Growing E-commerce and Digital Infrastructure

The rapid expansion of e-commerce and digital infrastructure in Japan is significantly influencing the ups battery market. As online shopping continues to rise, businesses are increasingly reliant on uninterrupted power supply to maintain operations and ensure customer satisfaction. The ups battery market is thus experiencing heightened demand from logistics centers, warehouses, and retail operations that require reliable backup power solutions. This trend is further supported by the increasing number of data centers that require robust power systems to handle the growing volume of data traffic. Consequently, the ups battery market is poised for growth as companies invest in reliable energy solutions to support their digital transformation efforts.

Technological Innovations in Battery Chemistry

Innovations in battery chemistry are playing a crucial role in shaping the ups battery market in Japan. The development of advanced lithium-ion and solid-state batteries is enhancing performance, longevity, and safety. These technological advancements are likely to meet the increasing demands for higher energy density and faster charging times. As a result, the ups battery market is witnessing a shift towards more efficient and reliable battery solutions. Companies are investing heavily in research and development to create batteries that not only perform better but also have a lower environmental impact. This focus on innovation is expected to drive market growth, as consumers and businesses alike seek cutting-edge solutions for their energy needs.