Integration of Renewable Energy Sources

The ups battery market in Germany is significantly influenced by the integration of renewable energy sources into the national grid. As the country aims to transition towards a more sustainable energy model, the demand for energy storage solutions, including UPS systems, is expected to rise. In 2025, it is estimated that around 30% of the energy consumed will come from renewable sources, necessitating efficient energy management systems. UPS batteries play a crucial role in stabilizing power supply and ensuring that renewable energy can be effectively utilized. This shift towards greener energy solutions is likely to propel the ups battery market, as businesses and households seek reliable backup systems to complement their renewable energy investments.

Growing Awareness of Cybersecurity Risks

The ups battery market in Germany is increasingly shaped by the growing awareness of cybersecurity risks. As businesses digitize their operations, the potential for power disruptions due to cyberattacks becomes a pressing concern. In 2025, it is estimated that cyber threats could lead to significant financial losses, prompting organizations to invest in robust backup power solutions. UPS systems are essential in safeguarding against power outages that could compromise data integrity and operational continuity. This heightened focus on cybersecurity is likely to drive demand for the ups battery market, as companies seek to mitigate risks associated with power failures and ensure the security of their digital assets.

Rising Demand for Uninterrupted Power Supply

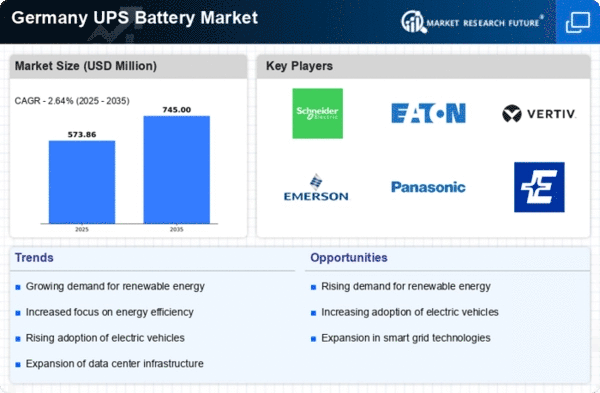

The ups battery market in Germany experiences a notable increase in demand due to the growing reliance on uninterrupted power supply across various sectors. Industries such as IT, healthcare, and telecommunications are increasingly dependent on consistent power to maintain operations. In 2025, the market is projected to grow at a CAGR of approximately 6.5%, driven by the need for reliable power solutions. This trend is further fueled by the expansion of data centers and the increasing adoption of cloud computing services, which require robust backup systems. As businesses prioritize operational continuity, the ups battery market is likely to see sustained growth, reflecting the critical role of power reliability in modern infrastructure.

Technological Innovations in Battery Technology

The ups battery market in Germany is witnessing a wave of technological innovations that enhance battery performance and efficiency. Advances in lithium-ion and solid-state battery technologies are leading to longer lifespans, faster charging times, and improved energy density. In 2025, the market is expected to see a shift towards these advanced battery solutions, which could account for over 40% of total UPS sales. These innovations not only improve the reliability of power backup systems but also reduce the overall cost of ownership for consumers. As businesses and individuals seek more efficient and sustainable power solutions, the ups battery market is likely to thrive, driven by these technological advancements.

Increased Investment in Infrastructure Development

Germany's ups battery market is poised for growth due to increased investment in infrastructure development. The government has committed substantial funds towards modernizing transportation, telecommunications, and energy infrastructure. In 2025, infrastructure spending is projected to reach €50 billion, creating a favorable environment for the ups battery market. As new facilities and systems are constructed, the need for reliable power backup solutions becomes paramount. This investment not only enhances the resilience of critical infrastructure but also drives demand for UPS systems across various sectors, including public services and private enterprises. Consequently, the ups battery market is likely to benefit from this influx of capital and the associated demand for power reliability.