Growth of Renewable Energy Sources

The ups battery market is poised for growth as the adoption of renewable energy sources continues to rise. With an increasing number of solar and wind energy installations, there is a growing need for energy storage solutions to manage the intermittent nature of these resources. Ups batteries play a crucial role in storing excess energy generated during peak production times, ensuring a reliable power supply when demand is high. This trend is expected to contribute to the ups battery market, as more businesses and households seek to integrate energy storage systems into their operations. The market could see a substantial increase in demand as renewable energy becomes more prevalent.

Regulatory Compliance and Standards

The ups battery market is significantly influenced by regulatory compliance and standards set forth by governmental bodies. These regulations often mandate specific performance and safety standards for battery systems, particularly in critical applications such as hospitals and data centers. Compliance with these regulations not only ensures safety but also enhances the reliability of power systems. The ups battery market is adapting to these requirements, which may lead to increased investments in research and development to meet evolving standards. As a result, manufacturers are likely to innovate and improve their product offerings, thereby driving market growth.

Rising Awareness of Energy Efficiency

The ups battery market is influenced by a growing awareness of energy efficiency among consumers and businesses. As energy costs continue to rise, organizations are increasingly seeking solutions that not only provide backup power but also optimize energy consumption. Ups batteries that offer energy-efficient features are becoming more attractive to consumers, leading to a shift in purchasing decisions. This trend is likely to propel the ups battery market forward, as manufacturers respond to consumer demands for more efficient products. The emphasis on energy efficiency may also encourage the development of smart battery systems that integrate with energy management solutions.

Technological Innovations in Battery Chemistry

The ups battery market is benefiting from ongoing technological innovations in battery chemistry, which are enhancing performance and efficiency. Advances in materials science are leading to the development of batteries with higher energy densities, longer lifespans, and faster charging capabilities. These innovations are particularly relevant in the context of lithium-ion technology, which is becoming increasingly popular in the ups battery market. As manufacturers strive to improve battery performance, the market is likely to witness a shift towards more advanced battery solutions that meet the demands of modern applications. This could result in a competitive landscape where innovation drives market dynamics.

Increasing Demand for Uninterrupted Power Supply

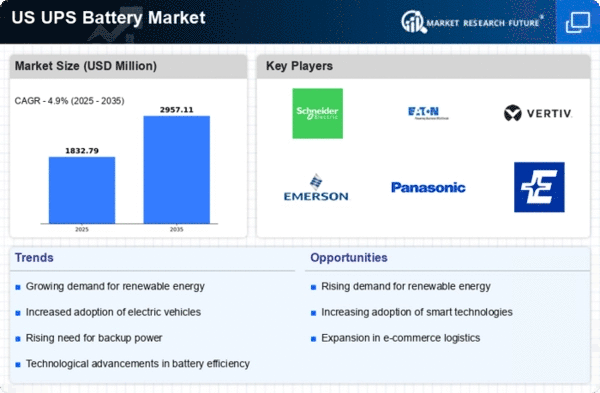

The ups battery market is experiencing a notable surge in demand due to the increasing reliance on uninterrupted power supply across various sectors. Industries such as healthcare, telecommunications, and data centers require consistent power to maintain operations and safeguard sensitive equipment. This trend is further amplified by the growing number of electronic devices and the need for backup solutions during power outages. According to recent data, the ups battery market is projected to grow at a CAGR of approximately 6.5% over the next five years, indicating a robust expansion driven by this demand. As businesses prioritize operational continuity, the ups battery market is likely to see sustained growth.