Increased Healthcare Expenditure

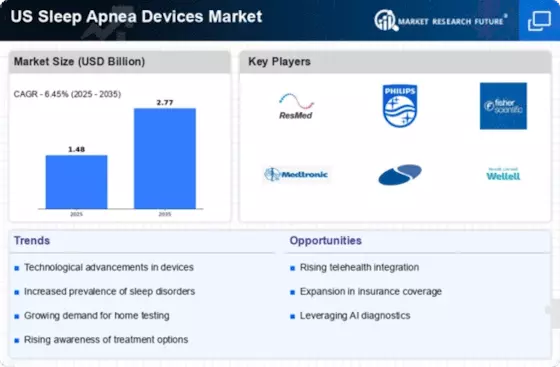

The rising healthcare expenditure in the United States significantly influences the US Sleep Apnea Devices Market. With healthcare spending projected to reach over $6 trillion by 2027, there is a growing focus on preventive care and chronic disease management, including sleep disorders. This financial commitment allows for better access to diagnostic tools and treatment options for sleep apnea. Insurance coverage for sleep apnea devices is also expanding, making these products more accessible to patients. As healthcare systems prioritize the management of sleep-related conditions, the US Sleep Apnea Devices Market is likely to experience robust growth, driven by increased investment in patient care.

Rising Prevalence of Sleep Apnea

The increasing prevalence of sleep apnea in the United States is a primary driver for the US Sleep Apnea Devices Market. Recent estimates suggest that approximately 22 million Americans suffer from sleep apnea, with a significant portion remaining undiagnosed. This growing patient population necessitates the development and distribution of effective treatment devices. As awareness of the condition rises, more individuals seek diagnosis and treatment, thereby expanding the market. The demand for devices such as CPAP machines and oral appliances is likely to increase as healthcare providers emphasize the importance of addressing sleep disorders. Consequently, the US Sleep Apnea Devices Market is poised for growth as it adapts to meet the needs of a larger, more informed consumer base.

Growing Awareness of Sleep Health

The growing awareness of sleep health among the general population is a significant driver for the US Sleep Apnea Devices Market. Public health campaigns and educational initiatives have highlighted the importance of sleep quality and its impact on overall health. As individuals become more informed about the risks associated with untreated sleep apnea, such as cardiovascular diseases and diabetes, they are more likely to seek diagnosis and treatment. This heightened awareness is expected to lead to an increase in demand for sleep apnea devices, as consumers actively pursue solutions to improve their sleep quality. Consequently, the US Sleep Apnea Devices Market stands to benefit from this trend as more people recognize the value of addressing sleep disorders.

Technological Innovations in Device Design

Technological advancements play a crucial role in shaping the US Sleep Apnea Devices Market. Innovations in device design, such as the development of quieter, more comfortable CPAP machines and portable monitoring devices, enhance user experience and compliance. The integration of smart technology, including mobile applications that track sleep patterns and device usage, further encourages patient engagement. As manufacturers invest in research and development, the introduction of new features and improved functionalities is expected to attract more users. This trend indicates a shift towards more sophisticated solutions that cater to individual needs, thereby driving the growth of the US Sleep Apnea Devices Market.

Shift Towards Home-Based Healthcare Solutions

The shift towards home-based healthcare solutions is reshaping the US Sleep Apnea Devices Market. As patients increasingly prefer receiving care in the comfort of their homes, there is a growing demand for portable and user-friendly sleep apnea devices. Home sleep testing and remote monitoring technologies are becoming more prevalent, allowing for convenient diagnosis and management of sleep apnea. This trend is further supported by advancements in telehealth, which facilitate consultations and follow-ups without the need for in-person visits. As the market adapts to these changes, the US Sleep Apnea Devices Market is likely to expand, driven by the increasing preference for home-based solutions.

Leave a Comment