Growth of Mobile Payment Solutions

The market is witnessing a notable shift towards mobile payment solutions, driven by changing consumer behaviours and technological advancements. The increasing adoption of contactless payment methods has led to a surge in mobile wallet usage, with approximately 40% of UK consumers now using mobile payment applications regularly. This trend is encouraging telecom operators to collaborate with financial institutions to offer integrated services that combine telecommunications and financial transactions. As a result, the wireless telecommunication-service market is likely to see a diversification of service offerings, with companies exploring new revenue streams through mobile payment solutions. This evolution could potentially reshape consumer interactions with mobile services, fostering greater loyalty and engagement.

Increased Investment in Cybersecurity Measures

As the wireless telecommunication-service market continues to expand, the importance of cybersecurity has become increasingly pronounced. With the rise in mobile data usage and the proliferation of connected devices, service providers are facing heightened risks of cyber threats. In response, many companies are allocating substantial resources towards enhancing their cybersecurity measures. Recent reports indicate that UK telecom operators are expected to invest over £1 billion in cybersecurity solutions by 2026. This investment is aimed at safeguarding customer data and maintaining trust in mobile services. Consequently, the focus on cybersecurity is likely to influence the competitive dynamics within the wireless telecommunication-service market, as companies that prioritize security may gain a competitive edge.

Regulatory Changes and Compliance Requirements

The wireless telecommunication-service market is significantly influenced by regulatory changes and compliance requirements imposed by the UK government and regulatory bodies. Recent initiatives aimed at enhancing consumer protection and promoting fair competition are reshaping the operational landscape for service providers. For instance, the introduction of new regulations regarding data privacy and security has compelled companies to invest in robust compliance frameworks. Additionally, the UK government has mandated that all mobile operators must provide coverage in rural areas, which could lead to increased operational costs but also presents opportunities for market expansion. These regulatory dynamics are likely to drive innovation and investment in the wireless telecommunication-service market, as companies adapt to meet new standards and consumer expectations.

Rising Consumer Expectations for Mobile Services

Consumer expectations in the wireless telecommunication-service market are evolving rapidly, with users demanding higher quality and more reliable mobile services. The proliferation of smartphones and mobile applications has led to an increased reliance on mobile connectivity for everyday activities, including work, entertainment, and social interaction. According to recent surveys, approximately 75% of UK consumers express dissatisfaction with their current mobile service providers, primarily due to issues related to coverage and speed. This dissatisfaction is prompting service providers to enhance their offerings, focusing on customer service and network reliability. As competition intensifies, companies are likely to invest more in customer-centric solutions, which could reshape the landscape of the wireless telecommunication-service market in the UK.

Technological Advancements in Network Infrastructure

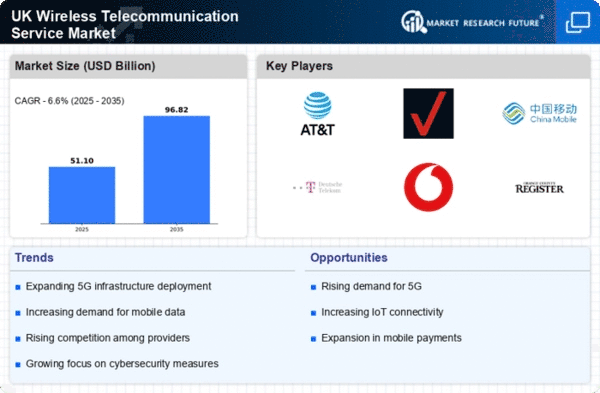

The wireless telecommunication-service market is experiencing a transformative phase driven by rapid technological advancements in network infrastructure. Innovations such as 5G technology are enhancing data transmission speeds and reducing latency, which is crucial for both consumers and businesses. The UK government has invested approximately £1.5 billion in 5G infrastructure, aiming to cover 85% of the population by 2027. This investment is expected to stimulate competition among service providers, leading to improved service offerings and pricing strategies. Furthermore, advancements in network slicing and edge computing are likely to enable more efficient resource allocation, thereby enhancing user experiences. As a result, The market is poised for significant growth, with projections indicating a compound annual growth rate (CAGR) of around 10% over the next five years.