Competitive Pricing Strategies

In the wireless telecommunication-service market, competitive pricing strategies are becoming increasingly vital as companies vie for market share. The landscape is characterized by aggressive pricing models, including unlimited data plans and bundled services, which are designed to attract and retain customers. As of November 2025, the average monthly cost for mobile services in the US is approximately $70, but this figure varies significantly based on service providers and plan features. The introduction of promotional offers and discounts is also prevalent, as companies seek to differentiate themselves in a crowded market. This price competition not only benefits consumers through lower costs but also challenges providers to innovate and enhance their service offerings to maintain profitability.

Emergence of 5G-Enabled Applications

The emergence of 5G-enabled applications is transforming the wireless telecommunication-service market, creating new opportunities for growth. Industries such as healthcare, automotive, and entertainment are increasingly leveraging 5G technology to develop innovative applications that require high-speed connectivity and low latency. For instance, telemedicine solutions and autonomous vehicles are becoming more viable with the capabilities offered by 5G networks. As of November 2025, it is projected that the number of 5G subscriptions in the US will surpass 200 million, indicating a robust adoption rate. This trend not only enhances the service offerings of telecommunications companies but also stimulates demand for advanced devices and services, thereby driving overall market growth.

Rising Demand for Mobile Data Services

The wireless telecommunication-service market is witnessing a significant increase in demand for mobile data services. With the proliferation of smartphones and IoT devices, consumers are utilizing more data than ever before. Reports indicate that mobile data traffic in the US is expected to reach 50 exabytes per month by 2025, reflecting a growth rate of over 30% from previous years. This surge in data consumption is compelling service providers to enhance their offerings and invest in robust network infrastructure. Additionally, the growing trend of remote work and digital services is further propelling the need for reliable mobile connectivity. As a result, companies in the wireless telecommunication-service market are focusing on expanding their data plans and improving service quality to cater to this evolving consumer behavior.

Increased Investment in Network Security

As cyber threats continue to evolve, the wireless telecommunication-service market is witnessing a heightened focus on network security. Service providers are investing significantly in advanced security measures to protect user data and maintain trust. In 2025, it is estimated that spending on cybersecurity solutions within the telecommunications sector will exceed $10 billion in the US. This investment is crucial, as breaches can lead to substantial financial losses and damage to brand reputation. Moreover, regulatory requirements are pushing companies to adopt stringent security protocols, further driving investment in this area. By prioritizing network security, companies in the wireless telecommunication-service market aim to enhance customer confidence and ensure compliance with evolving regulations.

Technological Advancements in Infrastructure

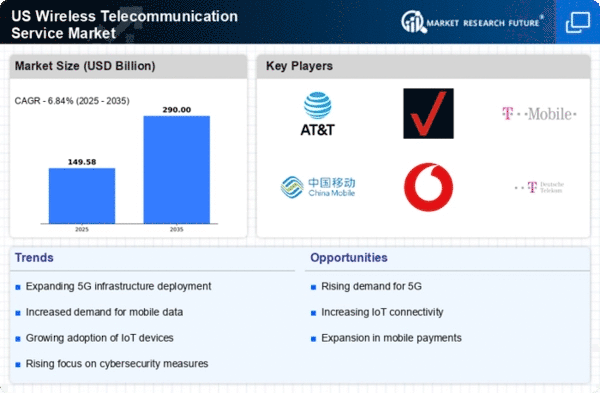

The wireless telecommunication-service market is experiencing a surge in technological advancements, particularly in network infrastructure. Innovations such as small cell technology and advanced antenna systems are enhancing network capacity and coverage. As of 2025, the market is projected to grow at a CAGR of approximately 8.5%, driven by the need for faster and more reliable services. These advancements enable service providers to meet the increasing demand for data and improve overall service quality. Furthermore, the integration of artificial intelligence and machine learning in network management is optimizing operational efficiency, thereby reducing costs and enhancing customer satisfaction. This technological evolution is crucial for maintaining competitiveness in the wireless telecommunication-service market, as companies strive to offer superior connectivity solutions.