Shift Towards Flexible Pricing Models

The wireless telecommunication-service market in France is witnessing a shift towards flexible pricing models, reflecting changing consumer preferences. As users seek more personalized and cost-effective solutions, service providers are adapting their pricing strategies to accommodate diverse needs. Recent surveys indicate that approximately 60% of consumers prefer plans that offer customizable data packages and no long-term contracts. This trend encourages competition among operators, prompting them to innovate and differentiate their offerings. Consequently, the wireless telecommunication-service market is likely to experience a transformation in how services are marketed and sold, with an emphasis on flexibility and customer-centric approaches.

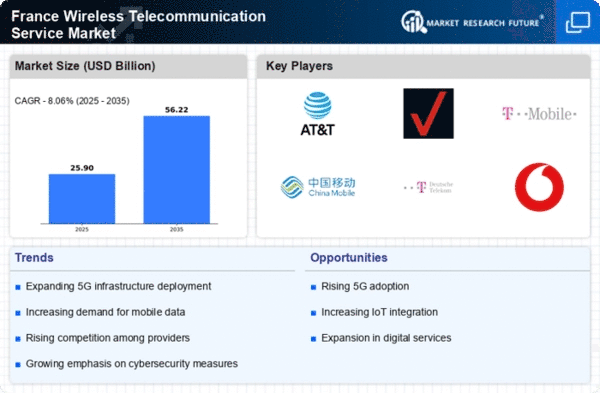

Advancements in Network Infrastructure

Advancements in network infrastructure are pivotal to the evolution of the wireless telecommunication-service market in France. The ongoing deployment of advanced technologies, such as 5G, is reshaping the landscape by enabling faster and more reliable connections. As of November 2025, it is estimated that over 80% of urban areas in France will have access to 5G networks, significantly enhancing user experiences. This technological leap not only benefits consumers but also opens new avenues for businesses, particularly in sectors like healthcare and transportation. The continuous improvement of network infrastructure is likely to drive further growth in the wireless telecommunication-service market, fostering innovation and enhancing service delivery.

Growing Demand for High-Speed Connectivity

The wireless telecommunication service market in France experiences a notable surge in demand for high-speed connectivity. As consumers increasingly rely on mobile devices for various applications, the need for faster data transmission becomes paramount. Recent data indicates that mobile data traffic in France is projected to grow by approximately 40% annually, driven by the proliferation of streaming services and online gaming. This trend compels service providers to enhance their infrastructure, thereby fostering competition and innovation within the wireless telecommunication-service market. The emphasis on high-speed connectivity not only caters to individual consumers but also supports businesses seeking efficient communication solutions, thus expanding the overall market landscape.

Integration of Internet of Things (IoT) Solutions

The integration of Internet of Things (IoT) solutions significantly influences The wireless telecommunication service market in France. As industries adopt IoT technologies for automation and data collection, the demand for reliable wireless connectivity escalates. In 2025, it is estimated that the number of connected IoT devices in France will exceed 100 million, necessitating robust telecommunication services to support this growth. This trend presents opportunities for service providers to develop specialized IoT plans and services, enhancing their offerings in the wireless telecommunication-service market. Furthermore, the rise of smart cities and connected infrastructure underscores the importance of seamless connectivity, driving further investment in telecommunication networks.

Regulatory Support for Telecommunications Expansion

Regulatory support plays a crucial role in shaping the wireless telecommunication-service market in France. The French government actively promotes policies aimed at expanding telecommunications infrastructure, particularly in rural areas. Recent initiatives include funding programs and incentives for service providers to enhance network coverage and quality. This regulatory environment encourages competition among operators, leading to improved service offerings and pricing strategies. As a result, the wireless telecommunication-service market is likely to witness increased investment in infrastructure development, ultimately benefiting consumers through enhanced access to reliable services. The government's commitment to digital inclusion further solidifies the market's growth trajectory.