Emergence of IoT Applications

The wireless telecommunication-service market in Canada is significantly influenced by the rapid emergence of Internet of Things (IoT) applications. As various sectors, including healthcare, agriculture, and smart cities, increasingly adopt IoT technologies, the demand for reliable wireless connectivity intensifies. It is estimated that the number of connected IoT devices in Canada will reach over 1 billion by 2026, creating a substantial opportunity for telecommunication providers. This growth necessitates the development of advanced network solutions, such as low-power wide-area networks (LPWAN), to support the diverse needs of IoT applications. As a result, the wireless telecommunication-service market is likely to witness increased investments in infrastructure and innovative service offerings tailored to IoT connectivity, thereby enhancing overall market dynamics.

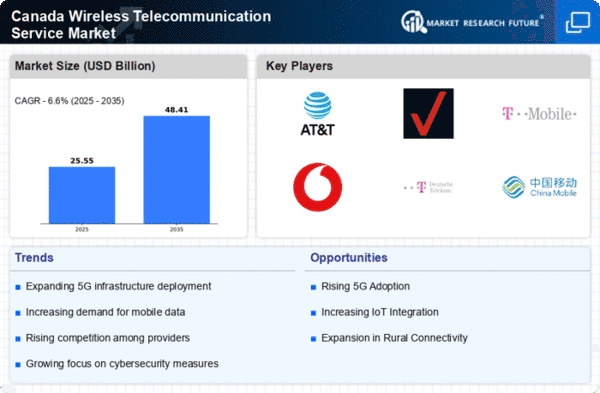

Increased Mobile Data Consumption

The wireless telecommunication-service market in Canada is experiencing a notable surge in mobile data consumption. As consumers increasingly rely on smartphones and mobile devices for various activities, including streaming, gaming, and social media, the demand for high-speed data services escalates. Recent statistics indicate that mobile data traffic in Canada is projected to grow by approximately 30% annually, driven by the proliferation of video content and mobile applications. This trend compels service providers to enhance their infrastructure and offer more robust data plans, thereby fostering competition within the wireless telecommunication-service market. Consequently, companies are likely to invest in expanding their network capabilities to accommodate this growing demand, which may lead to improved service quality and customer satisfaction.

Shift Towards Unlimited Data Plans

In the Canadian wireless telecommunication-service market, there is a discernible shift towards unlimited data plans as consumers seek more flexibility and value in their mobile services. Recent surveys indicate that approximately 60% of Canadian consumers prefer unlimited data options, reflecting a growing desire to avoid overage charges and enjoy uninterrupted access to online content. This trend has prompted service providers to reevaluate their pricing strategies and introduce competitive unlimited data plans. As a result, the market landscape is evolving, with companies striving to differentiate themselves through innovative pricing models and enhanced customer experiences. This shift not only impacts consumer behavior but also compels providers to invest in network enhancements to ensure that they can deliver the necessary bandwidth and reliability associated with unlimited data offerings.

Regulatory Support for Market Growth

Regulatory support is a crucial driver for the wireless telecommunication-service market in Canada. The Canadian Radio-television and Telecommunications Commission (CRTC) has implemented various policies aimed at promoting competition and ensuring fair access to telecommunications services. These regulations encourage new entrants into the market, fostering innovation and driving down prices for consumers. Additionally, initiatives aimed at expanding broadband access to underserved areas are likely to enhance market penetration and stimulate growth. As regulatory frameworks continue to evolve, they may provide further opportunities for investment and development within the wireless telecommunication-service market, ultimately benefiting consumers through improved service quality and affordability.

Technological Advancements in Network Infrastructure

Technological advancements in network infrastructure are playing a pivotal role in shaping the wireless telecommunication-service market in Canada. The ongoing deployment of 5G technology is expected to revolutionize the market by providing faster data speeds, lower latency, and improved connectivity. As of November 2025, several Canadian cities have already begun to experience the benefits of 5G networks, with coverage expanding rapidly. This technological evolution encourages service providers to invest in upgrading their existing infrastructure, which may lead to enhanced service offerings and increased competition. Furthermore, the integration of artificial intelligence and machine learning in network management is likely to optimize performance and customer service, thereby contributing to the overall growth of the wireless telecommunication-service market.