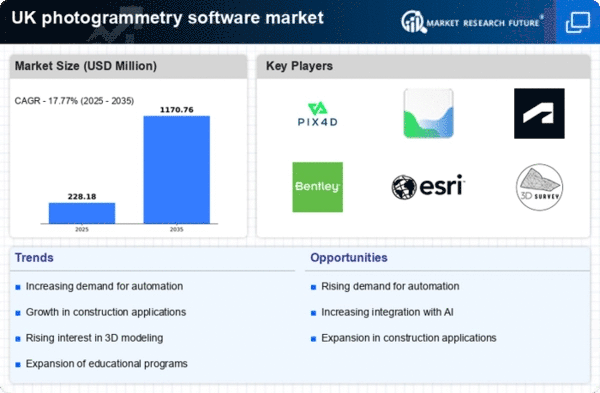

Rising Demand for 3D Mapping Solutions

The increasing need for accurate 3D mapping solutions across various sectors is driving the photogrammetry software market. Industries such as construction, urban planning, and environmental monitoring are increasingly adopting these technologies to enhance project efficiency and accuracy. In the UK, the construction sector alone is projected to grow by 4.5% annually, leading to a heightened demand for photogrammetry software. This software enables professionals to create detailed models and visualizations, which are essential for effective decision-making. As the demand for precision in mapping continues to rise, the photogrammetry software market is likely to experience significant growth, with companies investing in advanced software solutions to meet these needs.

Growing Adoption in Heritage Preservation

The photogrammetry software market is witnessing a surge in adoption for heritage preservation projects. In the UK, numerous historical sites and monuments are being digitally documented using photogrammetry techniques to create 3D models for restoration and conservation purposes. This trend is supported by government initiatives aimed at preserving cultural heritage, which often allocate funding for such projects. The market for photogrammetry software in this context is expected to grow as more institutions recognize the value of digital preservation. By employing photogrammetry, stakeholders can ensure that historical sites are accurately represented and maintained for future generations, thus driving demand in the industry.

Emergence of Educational and Training Programs

The emergence of educational and training programs focused on photogrammetry is fostering growth in the market. Universities and technical institutions in the UK are increasingly incorporating photogrammetry into their curricula, preparing a new generation of professionals skilled in this technology. This trend is likely to enhance the overall understanding and application of photogrammetry software across various industries. As more individuals become proficient in these tools, the demand for photogrammetry software is expected to rise. Furthermore, industry partnerships with educational institutions may lead to the development of tailored software solutions, further stimulating market growth.

Technological Advancements in Imaging Techniques

Technological advancements in imaging techniques are significantly impacting the photogrammetry software market. Innovations such as high-resolution cameras, drones, and LiDAR technology are enhancing the capabilities of photogrammetry software, allowing for more accurate and efficient data collection. In the UK, the use of drones for aerial surveys has increased by over 30% in recent years, indicating a shift towards more sophisticated imaging methods. These advancements not only improve the quality of data but also reduce the time required for data acquisition and processing. As a result, businesses are increasingly adopting photogrammetry software to leverage these technologies, thereby driving market growth.

Increased Investment in Infrastructure Development

The UK government has committed substantial investments in infrastructure development, which is positively influencing the photogrammetry software market. With plans to enhance transportation networks, utilities, and public facilities, the demand for precise mapping and surveying tools is on the rise. Photogrammetry software plays a crucial role in these projects by providing accurate data for planning and execution. The UK infrastructure sector is projected to grow by 5% annually, creating a robust market for photogrammetry solutions. As infrastructure projects become more complex, the reliance on advanced software for accurate modeling and analysis is likely to increase, further propelling market growth.