Government Initiatives and Funding

Government initiatives in the UK are playing a crucial role in the expansion of the lidar market. Various funding programs aimed at promoting smart city projects and environmental monitoring are increasing the demand for lidar technologies. For instance, the UK government has allocated £100 million for research and development in geospatial technologies, which includes lidar systems. This financial support not only fosters innovation but also encourages collaboration between public and private sectors, thereby enhancing the overall market landscape. Such initiatives are expected to propel the lidar market forward in the coming years.

Integration with Emerging Technologies

The integration of lidar technology with emerging technologies such as artificial intelligence (AI) and machine learning is reshaping the lidar market. This synergy enhances data analysis capabilities, allowing for more sophisticated applications in sectors like transportation and security. In the UK, companies are increasingly leveraging AI to process lidar data, resulting in improved operational efficiencies. The potential for real-time data processing and analysis could lead to a market expansion, with estimates suggesting a growth rate of 30% in AI-integrated lidar solutions by 2028. This integration is expected to be a pivotal driver for the lidar market.

Rising Demand for 3D Mapping Solutions

The demand for 3D mapping solutions is significantly influencing the lidar market in the UK. Industries such as construction, mining, and agriculture are increasingly adopting lidar technology for its ability to provide precise topographical data. The market for 3D mapping is anticipated to reach £500 million by 2027, driven by the need for accurate land surveys and project planning. This trend indicates a shift towards more data-driven decision-making processes, which could further enhance the adoption of lidar systems across various sectors. Consequently, the growth in 3D mapping applications is likely to be a key driver for the lidar market.

Technological Advancements in Lidar Systems

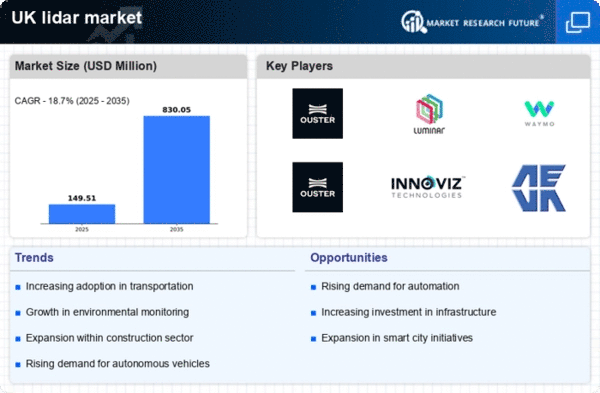

The lidar market is experiencing a surge in technological advancements, particularly in sensor capabilities and data processing techniques. Innovations such as solid-state lidar and enhanced algorithms are improving accuracy and reducing costs. This is particularly relevant in the UK, where the market is projected to grow at a CAGR of 25% from 2025 to 2030. These advancements enable applications across various sectors, including autonomous vehicles and urban planning, thereby expanding the market's potential. As the technology matures, it is likely to attract more investments, further driving growth in the lidar market.

Increased Focus on Environmental Sustainability

The growing emphasis on environmental sustainability is significantly impacting the lidar market in the UK. Lidar technology is being utilized for various environmental applications, including forest management, flood mapping, and wildlife monitoring. As businesses and governments strive to meet sustainability goals, the demand for accurate environmental data is rising. Reports indicate that the market for lidar in environmental applications could reach £300 million by 2026. This focus on sustainability not only drives the adoption of lidar systems but also positions the technology as a vital tool in addressing climate change challenges, thereby propelling the lidar market forward.