Expansion of Robotics and Automation

The expansion of robotics and automation is a key driver for the 3d lidar-sensor market. As industries increasingly adopt robotic systems for tasks such as material handling, inspection, and autonomous navigation, the integration of lidar sensors becomes essential for enhancing operational efficiency. Lidar technology provides robots with the ability to perceive their environment in three dimensions, enabling them to navigate complex spaces safely and effectively. The robotics market in the US is projected to reach $40 billion by 2025, with a significant portion of this growth attributed to the incorporation of advanced sensing technologies like lidar. This trend suggests that the 3d lidar-sensor market will continue to thrive as automation becomes more prevalent across various sectors.

Growing Demand for Precision in Surveying

The need for precision in surveying and mapping is a critical driver for the 3d lidar-sensor market. As industries such as construction, mining, and forestry require accurate topographical data, lidar technology offers unparalleled precision and efficiency. The ability to capture millions of data points per second enables detailed analysis and visualization of landscapes, which is essential for project planning and execution. In the US, the surveying market is expected to reach $10 billion by 2026, with a substantial portion attributed to lidar technology. This growing demand for precision in surveying is likely to propel the 3d lidar-sensor market forward, as companies seek to leverage advanced technologies for competitive advantage.

Increased Investment in Smart City Initiatives

The push towards smart city initiatives is significantly influencing the 3d lidar-sensor market. As urban areas strive to enhance infrastructure, improve public services, and promote sustainability, lidar technology plays a pivotal role in urban planning and management. The US government has allocated substantial funding for smart city projects, with investments expected to exceed $100 billion by 2027. This funding is likely to drive the adoption of 3d lidar sensors for applications such as traffic management, environmental monitoring, and public safety. Consequently, the 3d lidar-sensor market is poised to benefit from these initiatives, as cities increasingly rely on advanced technologies to address urban challenges.

Rising Applications in Environmental Monitoring

The is experiencing a rise in applications related to environmental monitoring.. As concerns about climate change and natural resource management grow, organizations are turning to lidar technology for its ability to provide detailed and accurate data on vegetation, land use, and topography. This technology is instrumental in assessing forest biomass, monitoring coastal erosion, and managing water resources. The environmental monitoring sector is projected to grow at a CAGR of 20% through 2030, indicating a strong demand for lidar solutions. As regulatory frameworks become more stringent, the 3d lidar-sensor market is likely to expand, driven by the need for precise data to inform policy and conservation efforts.

Technological Advancements in Sensor Capabilities

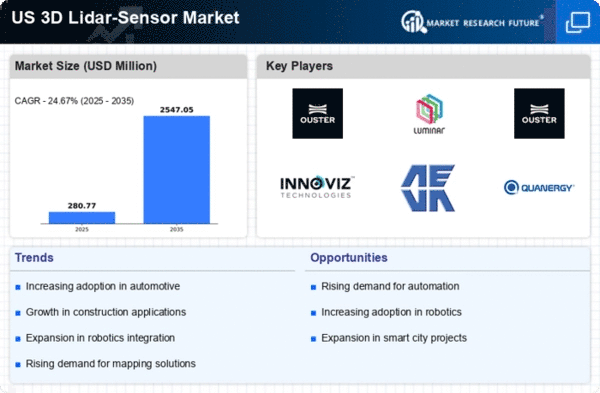

The 3d lidar-sensor market is experiencing a surge in technological advancements that enhance sensor capabilities. Innovations in laser technology, data processing algorithms, and miniaturization are driving the development of more efficient and accurate sensors. For instance, the integration of artificial intelligence with lidar systems allows for real-time data analysis, improving decision-making processes across various applications. The market is projected to grow at a CAGR of approximately 25% from 2025 to 2030, indicating a robust demand for advanced lidar solutions. As industries increasingly recognize the value of high-resolution 3D mapping, the is expected to expand significantly., catering to sectors such as transportation, urban planning, and environmental monitoring.