Corporate Sustainability Initiatives

The electric truck market is being propelled by the increasing emphasis on corporate sustainability initiatives among UK businesses. Many companies are adopting sustainability as a core component of their operational strategies, driven by consumer demand for environmentally friendly practices. This shift is leading to a greater investment in electric trucks, as businesses seek to reduce their carbon footprints and enhance their brand image. In 2025, it is estimated that over 60% of UK companies have integrated sustainability goals into their logistics operations, which includes transitioning to electric fleets. This trend not only supports the electric truck market but also encourages innovation in sustainable logistics solutions. As corporations strive to meet their sustainability targets, the demand for electric trucks is expected to rise, further solidifying their role in the transportation sector.

Increasing Environmental Regulations

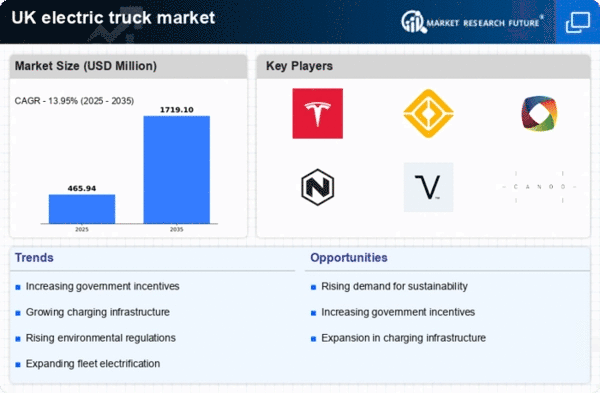

The electric truck market is experiencing a surge in demand due to increasing environmental regulations in the UK. The government has set ambitious targets to reduce carbon emissions, aiming for a net-zero economy by 2050. This regulatory framework encourages businesses to transition to electric vehicles, including trucks, to comply with stringent emissions standards. As a result, companies are investing in electric trucks to avoid penalties and enhance their sustainability profiles. The UK government has also introduced various incentives to support this transition, which further stimulates the electric truck market. In 2023, it was reported that the UK aims to have at least 300,000 electric vehicles on the road by 2030, indicating a robust growth trajectory for the electric truck market. This regulatory environment is likely to continue driving innovation and investment in electric truck technologies.

Advancements in Charging Infrastructure

The electric truck market is significantly influenced by advancements in charging infrastructure across the UK. The government and private sector are investing heavily in expanding the network of charging stations, which is crucial for the widespread adoption of electric trucks. As of 2025, there are over 30,000 public charging points available, with plans to increase this number substantially in the coming years. This expansion not only alleviates range anxiety among fleet operators but also enhances the operational efficiency of electric trucks. Furthermore, the development of ultra-fast charging technology is expected to reduce downtime, making electric trucks more appealing for logistics companies. The improved infrastructure is likely to facilitate a smoother transition to electric vehicles, thereby propelling the growth of the electric truck market in the UK.

Rising Fuel Prices and Economic Viability

The electric truck market is increasingly attractive due to rising fuel prices, which have made traditional diesel trucks less economically viable. As fuel costs continue to fluctuate, businesses are seeking alternatives that offer more predictable operating expenses. Electric trucks present a compelling solution, as they typically have lower energy costs compared to diesel vehicles. In 2025, the average cost of electricity for charging electric trucks is projected to be significantly lower than the equivalent cost of diesel fuel, enhancing the economic appeal of electric trucks. This shift in cost dynamics is prompting logistics companies to reevaluate their fleets and consider electric options. Consequently, the electric truck market is likely to see accelerated growth as businesses aim to mitigate the impact of rising fuel prices on their bottom lines.

Economic Incentives for Fleet Electrification

The electric truck market is benefiting from various economic incentives aimed at encouraging fleet electrification in the UK. The government has introduced grants and subsidies to offset the initial costs associated with purchasing electric trucks, making them more financially viable for businesses. For instance, the Plug-in Grant Scheme offers substantial financial support for electric vehicle purchases, which has been instrumental in driving sales in the electric truck market. Additionally, businesses can benefit from lower operating costs associated with electric trucks, such as reduced fuel expenses and maintenance costs. As of 2025, it is projected that the total cost of ownership for electric trucks will become competitive with traditional diesel trucks, further incentivizing fleet operators to make the switch. These economic factors are likely to play a crucial role in the continued growth of the electric truck market.