Rising Fuel Costs

The escalating costs of traditional fuels are driving the electric truck market. As fuel prices fluctuate, companies are increasingly seeking alternatives to mitigate operational expenses. In 2025, the average price of diesel fuel has risen to approximately $4.00 per gallon, prompting logistics firms to explore electric trucks as a cost-effective solution. Electric trucks, with their lower energy costs, present a compelling case for businesses aiming to reduce their fuel expenditures. This shift not only enhances profitability but also aligns with sustainability goals, as companies strive to lower their carbon footprints. Consequently, the rising fuel costs are likely to propel the adoption of electric trucks, making them a more attractive option in the competitive landscape of the electric truck market.

Environmental Regulations

Stringent environmental regulations are significantly influencing the electric truck market. In response to growing concerns about air quality and climate change, federal and state governments have implemented stricter emissions standards. For instance, the Environmental Protection Agency (EPA) has set ambitious targets for reducing greenhouse gas emissions from heavy-duty vehicles. These regulations compel manufacturers and fleet operators to transition towards cleaner alternatives, such as electric trucks. As compliance becomes increasingly critical, the electric truck market is poised for growth, as businesses seek to meet regulatory requirements while enhancing their public image. The pressure to adhere to these regulations is likely to accelerate the shift towards electric trucks, thereby reshaping the industry landscape.

Technological Innovations

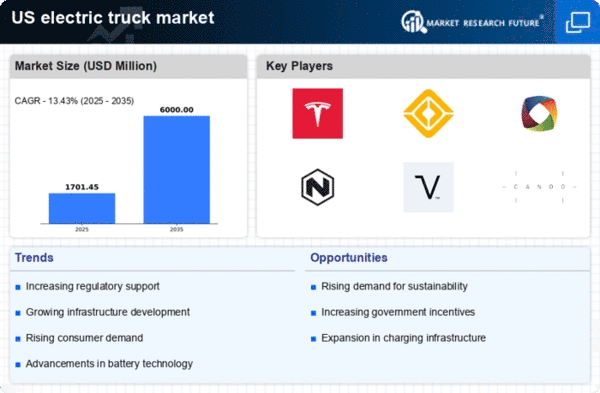

Technological innovations are playing a pivotal role in shaping the electric truck market. Advances in battery technology, such as the development of solid-state batteries, are enhancing the performance and range of electric trucks. In 2025, the average range of electric trucks has improved to over 300 miles on a single charge, making them more viable for long-haul applications. Additionally, innovations in charging infrastructure, including fast-charging stations, are addressing range anxiety among potential users. These technological advancements not only improve the operational efficiency of electric trucks but also contribute to their growing acceptance in the logistics sector. As technology continues to evolve, the electric truck market is likely to witness increased adoption rates, driven by enhanced capabilities and reduced operational barriers.

Evolving Consumer Preferences

Evolving consumer preferences are reshaping the electric truck market. As awareness of environmental issues grows, consumers are increasingly favoring companies that demonstrate a commitment to sustainability. In 2025, studies reveal that nearly 60% of consumers are willing to pay a premium for products delivered by environmentally friendly vehicles. This shift in consumer behavior is prompting logistics companies to adopt electric trucks to meet market demands. By aligning their operations with consumer values, businesses can enhance customer loyalty and attract new clientele. The electric truck market is thus likely to experience growth as companies respond to these changing preferences, integrating electric trucks into their fleets to appeal to environmentally conscious consumers.

Corporate Sustainability Initiatives

The increasing emphasis on corporate sustainability initiatives is significantly impacting the electric truck market. Many companies are adopting sustainability as a core component of their business strategies, aiming to reduce their environmental impact. In 2025, a survey indicates that over 70% of logistics companies are prioritizing the transition to electric vehicles as part of their sustainability goals. This trend is driven by consumer demand for environmentally friendly practices and the desire to enhance brand reputation. As businesses commit to reducing their carbon footprints, the electric truck market is expected to benefit from heightened investment and adoption. This alignment of corporate values with sustainable practices is likely to foster a more favorable environment for electric trucks, propelling their growth in the industry.