Rising Fuel Prices

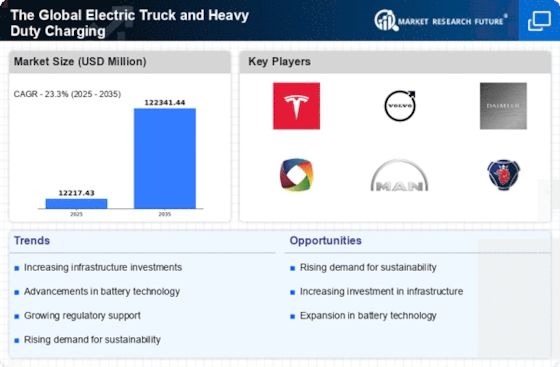

The volatility of fuel prices has a profound impact on The Global Electric Truck and Heavy Duty Charging Industry. As traditional fuel costs continue to rise, logistics companies are increasingly seeking alternative solutions to mitigate operational expenses. Electric trucks, which offer lower fuel and maintenance costs, present a viable option. In recent years, the cost of diesel has fluctuated dramatically, prompting many fleet operators to consider electric alternatives. By 2025, it is projected that the total cost of ownership for electric trucks could be 20% lower than that of their diesel counterparts, making them an attractive choice for businesses aiming to reduce costs.

Regulatory Support and Incentives

Regulatory frameworks and government incentives play a pivotal role in shaping The Global Electric Truck and Heavy Duty Charging Industry. Various governments are implementing stringent emissions regulations, which compel logistics companies to transition towards electric vehicles. For instance, the European Union has set ambitious targets for reducing greenhouse gas emissions, which has led to increased investments in electric truck technologies. Additionally, financial incentives such as tax credits and grants for electric vehicle purchases further stimulate market growth. In 2025, it is estimated that these incentives could lead to a 30% increase in electric truck adoption rates, thereby significantly impacting the overall market dynamics.

Corporate Fleet Electrification Goals

Many corporations are setting ambitious electrification goals for their fleets, which is a significant driver for The Global Electric Truck and Heavy Duty Charging Industry. Companies are increasingly recognizing the importance of sustainability in their operations, leading to commitments to transition to electric vehicles. For example, major logistics firms have announced plans to electrify a substantial portion of their fleets by 2030. This trend not only aligns with corporate social responsibility objectives but also enhances brand reputation. By 2025, it is anticipated that corporate commitments could result in a 40% increase in electric truck orders, thereby reshaping market dynamics.

Consumer Demand for Sustainable Solutions

The growing consumer demand for sustainable and environmentally friendly solutions is influencing The Global Electric Truck and Heavy Duty Charging Industry. As awareness of climate change and environmental issues rises, consumers are increasingly favoring companies that prioritize sustainability. This shift in consumer preferences is prompting logistics providers to adopt electric trucks as part of their sustainability strategies. By 2025, it is expected that companies with electric fleets will experience a 25% increase in customer loyalty, as consumers are more likely to support businesses that demonstrate a commitment to reducing their carbon footprint. This trend is likely to drive further investment in electric truck technologies.

Technological Innovations in Charging Infrastructure

Advancements in charging infrastructure technology are crucial for the expansion of The Global Electric Truck and Heavy Duty Charging Industry. The development of ultra-fast charging stations and smart grid technologies enhances the feasibility of electric trucks for long-haul operations. Innovations such as wireless charging and battery swapping systems are also emerging, potentially reducing downtime for fleet operators. As of 2025, the number of charging stations is expected to increase by 50%, facilitating greater accessibility for electric trucks. This infrastructure growth is likely to alleviate range anxiety among operators, thereby accelerating the adoption of electric trucks.