Rising Fuel Prices

The Europe Electric Truck Market is also influenced by the rising prices of fossil fuels, which have prompted logistics companies to seek more cost-effective alternatives. As fuel prices continue to fluctuate, the total cost of ownership for electric trucks becomes increasingly attractive. Studies indicate that electric trucks can offer lower operational costs over their lifespan compared to their diesel counterparts. This economic incentive is compelling for fleet operators, who are now more inclined to invest in electric trucks. Consequently, the shift towards electric vehicles is expected to accelerate, contributing to the overall growth of the Europe Electric Truck Market.

Corporate Sustainability Goals

The Europe Electric Truck Market is increasingly shaped by corporate sustainability goals adopted by major companies. Many organizations are committing to reducing their carbon footprints and enhancing their environmental responsibility. This trend is particularly evident in the logistics sector, where companies are integrating electric trucks into their fleets to meet sustainability targets. Research suggests that companies utilizing electric trucks can significantly lower their emissions, aligning with both regulatory requirements and consumer expectations. As more businesses prioritize sustainability, the demand for electric trucks is likely to rise, further propelling the growth of the Europe Electric Truck Market.

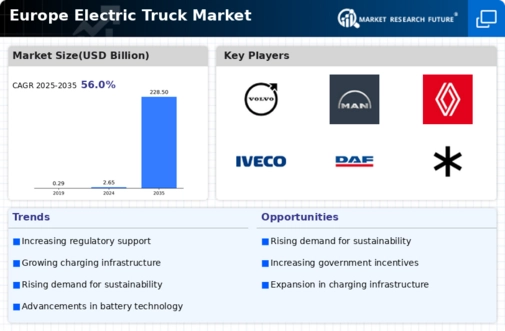

Increasing Environmental Regulations

The Europe Electric Truck Market is experiencing a surge in demand due to stringent environmental regulations imposed by various European governments. These regulations aim to reduce greenhouse gas emissions and promote sustainable transportation solutions. For instance, the European Union has set ambitious targets to cut carbon emissions by at least 55 percent by 2030. This regulatory landscape encourages logistics companies to transition from traditional diesel trucks to electric alternatives, thereby driving growth in the electric truck sector. As a result, many manufacturers are investing heavily in electric vehicle technology to comply with these regulations, which is likely to further enhance the market's expansion.

Advancements in Charging Infrastructure

The development of robust charging infrastructure is a critical driver for the Europe Electric Truck Market. Governments and private entities are investing significantly in expanding charging networks across Europe, which alleviates range anxiety among potential electric truck users. As of October 2025, there are over 300,000 public charging points across Europe, with plans for further expansion. This enhanced infrastructure not only supports the operational efficiency of electric trucks but also encourages more companies to adopt electric fleets. The availability of fast-charging stations is particularly vital for long-haul operations, making electric trucks a viable option for logistics companies.

Technological Innovations in Electric Vehicles

Technological innovations play a pivotal role in the growth of the Europe Electric Truck Market. Continuous advancements in battery technology, electric drivetrains, and vehicle design are enhancing the performance and efficiency of electric trucks. For example, the introduction of solid-state batteries promises to increase range and reduce charging times, making electric trucks more appealing to fleet operators. Furthermore, the integration of smart technologies, such as telematics and autonomous driving features, is expected to improve operational efficiency. As these innovations become more prevalent, they are likely to attract more investments and accelerate the adoption of electric trucks across Europe.

Leave a Comment