Rising Awareness of Oral Health

The increasing awareness of oral health among the UK population is driving the dental lasers market. As individuals become more informed about the importance of dental hygiene and the benefits of advanced dental treatments, the demand for innovative solutions like dental lasers is likely to rise. This trend is supported by various health campaigns and educational initiatives aimed at promoting better oral care. The dental lasers market is expected to benefit from this heightened awareness, as patients seek less invasive and more effective treatment options. Furthermore, the market could see a growth rate of approximately 15% annually, reflecting the shift towards modern dental practices that prioritize patient comfort and efficiency.

Growing Preference for Aesthetic Dentistry

The rising popularity of aesthetic dentistry is a key driver for the dental lasers market. As more individuals seek cosmetic dental procedures, the demand for tools that provide precise and effective results is increasing. Dental lasers are particularly well-suited for aesthetic applications, such as teeth whitening and gum contouring, due to their ability to deliver targeted treatment with minimal discomfort. This trend is likely to propel the dental lasers market forward, as practitioners aim to meet the growing expectations of patients seeking enhanced smiles. The market may experience a growth rate of approximately 10% annually, reflecting the increasing focus on aesthetic outcomes in dental care.

Shift Towards Minimally Invasive Procedures

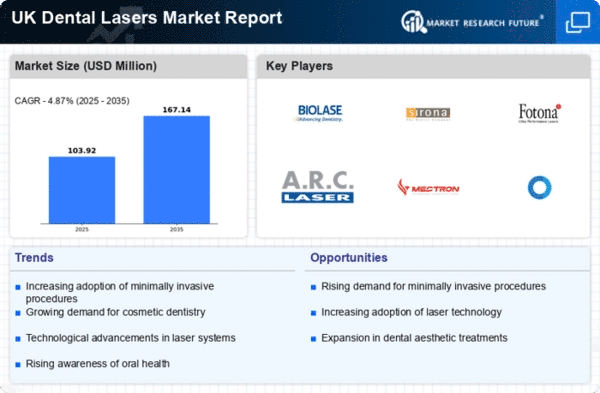

There is a notable shift towards minimally invasive dental procedures, which is positively impacting the dental lasers market. Patients increasingly prefer treatments that involve less discomfort and quicker recovery times. Dental lasers provide a solution by enabling procedures that are less traumatic compared to traditional methods. This trend is likely to encourage more dental practices to incorporate laser technology into their offerings. As a result, the dental lasers market may experience a compound annual growth rate (CAGR) of around 12% over the next few years, driven by the growing preference for less invasive treatment options among patients.

Increased Investment in Dental Infrastructure

The UK government and private sector are investing significantly in dental infrastructure, which is likely to bolster the dental lasers market. Enhanced funding for dental clinics and practices allows for the acquisition of advanced technologies, including dental lasers. This investment is crucial for improving patient care and expanding access to modern dental treatments. As more facilities upgrade their equipment, the demand for dental lasers is expected to rise. The dental lasers market could see an increase in value, potentially reaching £200 million by 2027, as infrastructure improvements facilitate the adoption of innovative dental technologies.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is a significant driver for the dental lasers market. As dental professionals adopt cutting-edge tools and techniques, the demand for dental lasers is likely to increase. These lasers offer precision, reduced recovery times, and enhanced patient experiences, making them an attractive option for practitioners. The dental lasers market is projected to expand as more clinics invest in these technologies to stay competitive. In the UK, the market is estimated to reach £150 million by 2026, indicating a robust growth trajectory fueled by technological advancements and the desire for improved treatment outcomes.