Government Initiatives and Funding

Government initiatives aimed at promoting advanced dental technologies are playing a crucial role in the growth of the dental lasers market in Japan. Various programs and funding opportunities are being introduced to encourage dental practitioners to adopt innovative technologies, including lasers. These initiatives not only provide financial support but also facilitate training and education for dental professionals. As a result, the market is likely to witness an increase in the number of practitioners utilizing laser technology in their practices. Recent reports suggest that government funding for dental technology has increased by 25% over the past year, indicating a strong commitment to enhancing dental care standards. This support is expected to drive further adoption of dental lasers, contributing to the overall expansion of the market.

Increasing Focus on Aesthetic Dentistry

The growing emphasis on aesthetic dentistry is significantly influencing the dental lasers market in Japan. As patients become more conscious of their appearance, the demand for cosmetic dental procedures is on the rise. Dental lasers offer precise and effective solutions for various aesthetic treatments, such as teeth whitening and gum contouring. This trend is likely to attract a broader patient base seeking cosmetic enhancements, thereby driving the growth of the dental lasers market. Recent surveys indicate that approximately 60% of patients express interest in aesthetic dental procedures, highlighting the potential for market expansion. As dental practitioners respond to this demand by incorporating laser technology into their services, the market is expected to flourish, reflecting the evolving preferences of patients.

Enhanced Training and Education Programs

The establishment of enhanced training and education programs for dental professionals is a key driver for the dental lasers market in Japan. As the technology evolves, it becomes imperative for practitioners to stay updated on the latest techniques and applications of dental lasers. Various institutions and organizations are now offering specialized training courses, which are likely to improve the proficiency of dental practitioners in utilizing laser technology. This increased competency not only boosts the confidence of practitioners but also enhances patient safety and treatment outcomes. Recent data suggests that participation in laser training programs has increased by 35% among dental professionals in Japan. This trend indicates a growing recognition of the importance of education in maximizing the benefits of dental lasers, ultimately contributing to the market's growth.

Technological Integration in Dental Practices

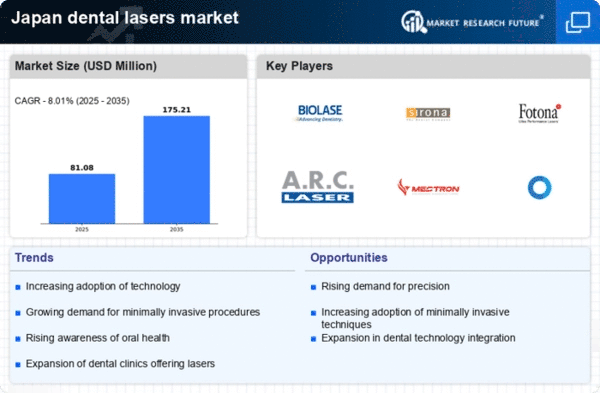

The integration of advanced technologies in dental practices is a significant driver for the dental lasers market in Japan. Innovations such as digital imaging and computer-aided design are being combined with laser technology to enhance treatment precision and outcomes. This technological synergy not only improves the efficiency of dental procedures but also elevates the standard of care provided to patients. As dental practitioners invest in state-of-the-art equipment, the market for dental lasers is likely to expand. Recent statistics indicate that approximately 40% of dental clinics in Japan have adopted laser technology, reflecting a strong trend towards modernization in dental practices. This integration is expected to continue, further solidifying the position of dental lasers as a vital component of contemporary dental care.

Rising Demand for Minimally Invasive Procedures

The dental lasers market in Japan is experiencing a notable surge in demand for minimally invasive procedures. Patients increasingly prefer treatments that reduce discomfort and recovery time, which dental lasers facilitate effectively. This shift in patient preference is likely driven by a growing awareness of the benefits associated with laser technology, such as reduced bleeding and faster healing. According to recent data, the adoption of laser-assisted procedures has increased by approximately 30% in the last few years. This trend suggests that dental practitioners are adapting their techniques to meet patient expectations, thereby enhancing the overall appeal of the dental lasers market. As a result, the market is poised for continued growth, with an increasing number of clinics integrating laser technology into their treatment offerings.