Shift Towards Aesthetic Dentistry

The growing trend towards aesthetic dentistry is a notable driver for the dental lasers market. As more patients seek cosmetic dental procedures, the demand for minimally invasive and precise treatments has surged. Dental lasers are particularly well-suited for aesthetic applications, such as teeth whitening, gum contouring, and cavity treatment, as they offer enhanced precision and reduced recovery times. This shift in patient preferences is reflected in market trends, with aesthetic procedures accounting for a significant portion of dental treatments in India. The dental lasers market is expected to capitalize on this trend, with an anticipated growth rate of 18% over the next few years, as more practitioners incorporate laser technology into their aesthetic offerings.

Government Initiatives and Support

Government initiatives aimed at improving healthcare infrastructure and access to dental care are likely to bolster the dental lasers market. Policies promoting the use of advanced medical technologies in public health facilities encourage dental practitioners to adopt laser systems. Additionally, financial incentives and subsidies for dental clinics investing in modern equipment can stimulate market growth. The Indian government has been actively working to enhance dental care services, which may lead to increased funding for dental practices. As a result, the dental lasers market could experience a notable uptick in demand, with projections indicating a potential market size increase of 30% by 2028.

Increasing Awareness of Oral Health

The rising awareness of oral health among the Indian population is a pivotal driver for the dental lasers market. As individuals become more informed about the importance of dental hygiene and the benefits of advanced dental technologies, the demand for innovative solutions like dental lasers is likely to increase. Educational campaigns and initiatives by dental associations have contributed to this awareness, leading to a growing preference for laser treatments over traditional methods. This shift is reflected in the market, where the adoption of dental lasers is projected to grow at a CAGR of approximately 15% over the next few years. The dental lasers market is thus positioned to benefit from this heightened focus on oral health, as patients seek effective and efficient treatment options.

Rising Incidence of Dental Disorders

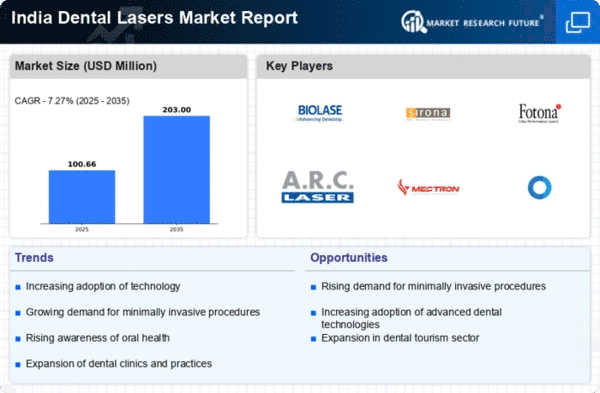

The increasing prevalence of dental disorders in India serves as a significant driver for the dental lasers market. Conditions such as periodontal disease, tooth decay, and oral cancers are becoming more common, necessitating advanced treatment options. Dental lasers offer precise and effective solutions for these issues, which may lead to quicker recovery times and reduced discomfort for patients. According to recent health statistics, nearly 60% of the Indian population suffers from some form of dental disease, creating a substantial demand for innovative treatment modalities. As dental professionals seek to enhance patient outcomes, the dental lasers market is expected to expand, with a projected market value reaching $200 million by 2027.

Technological Integration in Dental Practices

The integration of cutting-edge technology in dental practices is a crucial factor driving the dental lasers market. As dental clinics in India increasingly adopt digital tools and advanced equipment, the incorporation of laser technology becomes more feasible and attractive. This trend is supported by the availability of training programs and resources that equip dental professionals with the necessary skills to utilize lasers effectively. The dental lasers market is likely to see a surge in adoption rates as practitioners recognize the advantages of lasers, such as reduced treatment times and improved patient comfort. Furthermore, the market is projected to grow by approximately 20% in the next five years, reflecting the ongoing technological evolution within the dental sector.