Rising Cybersecurity Threats

The biometric banking market is experiencing heightened demand due to the increasing prevalence of cyber threats. Financial institutions in the UK are under constant pressure to safeguard sensitive customer data. As cyberattacks become more sophisticated, traditional security measures appear inadequate. Consequently, banks are investing in biometric solutions, which provide enhanced security through unique physical traits. The biometric banking market is projected to grow at a CAGR of 20% over the next five years, driven by the need for robust security measures. This trend indicates a shift towards more secure banking practices, as institutions seek to protect their assets and maintain customer trust. The integration of biometric technology not only mitigates risks but also enhances the overall security posture of financial institutions, making it a critical driver in the biometric banking market.

Regulatory Compliance and Standards

The biometric banking market is also driven by the need for regulatory compliance and adherence to industry standards. In the UK, financial institutions are required to implement robust security measures to protect customer data and prevent fraud. Regulatory bodies are increasingly endorsing biometric solutions as a means to enhance security and compliance. For instance, the Financial Conduct Authority (FCA) has issued guidelines that encourage the adoption of biometric technologies in banking. This regulatory support is likely to stimulate investment in biometric systems, as banks strive to meet compliance requirements while improving security. The biometric banking market is expected to benefit from this trend, as institutions align their operations with regulatory expectations, ensuring they remain competitive and secure.

Increased Investment in Fintech Innovations

The biometric banking market is witnessing a surge in investment in fintech innovations, which is driving the adoption of biometric technologies. Venture capital funding for fintech companies in the UK has reached record levels, with a significant portion allocated to biometric solutions. This influx of capital is enabling startups and established firms to develop cutting-edge biometric technologies that enhance security and user experience. As banks collaborate with fintech companies to integrate these innovations, the biometric banking market is likely to expand. The potential for improved efficiency and security through biometric solutions is attracting attention from investors, suggesting a promising future for the market. This trend indicates that as investment in fintech continues to grow, the biometric banking market will benefit from enhanced technological capabilities and increased adoption.

Technological Advancements in Biometric Systems

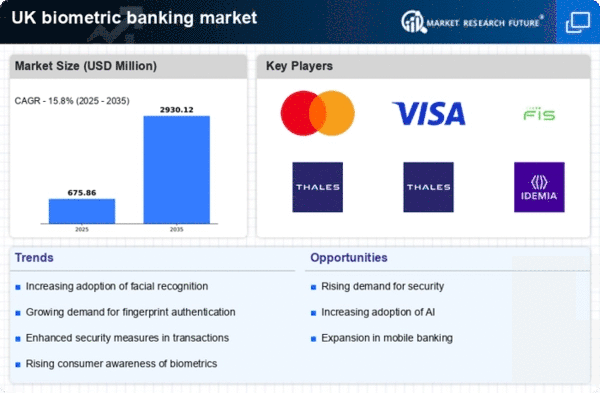

The biometric banking market is significantly influenced by rapid technological advancements in biometric systems. Innovations in fingerprint recognition, facial recognition, and iris scanning are transforming how banks authenticate customers. These technologies are becoming more accurate, faster, and cost-effective, which encourages their adoption in the banking sector. For instance, the introduction of AI-driven biometric solutions has improved the efficiency of identity verification processes. As a result, banks are likely to invest heavily in these technologies to streamline operations and enhance security. The biometric banking market is expected to reach a valuation of £3 billion by 2027, reflecting the growing reliance on advanced biometric systems. This trend suggests that as technology continues to evolve, the market will expand, driven by the need for more sophisticated and reliable authentication methods.

Consumer Demand for Convenient Banking Solutions

The biometric banking market is being propelled by a growing consumer demand for convenient and seamless banking solutions. Customers in the UK increasingly prefer quick and efficient access to their financial services, which biometric authentication can provide. By eliminating the need for passwords and PINs, biometric systems enhance user experience while maintaining security. Surveys indicate that over 70% of consumers are willing to adopt biometric solutions for banking, highlighting a shift in preferences towards more user-friendly options. This trend is likely to encourage banks to invest in biometric technologies, as they seek to meet customer expectations and improve service delivery. The biometric banking market is thus positioned for growth, as financial institutions adapt to changing consumer behaviours and preferences.