Rising Cybersecurity Concerns

In South Korea, the biometric banking market is significantly influenced by rising cybersecurity concerns. With the increasing frequency of cyberattacks and data breaches, financial institutions are compelled to adopt more secure authentication methods. Biometric solutions offer a robust alternative to traditional passwords, which are often vulnerable to hacking. As of 2025, it is estimated that nearly 70% of South Korean banks are implementing biometric authentication to enhance security measures. This shift is driven by the need to protect sensitive customer data and maintain trust in financial services. The biometric banking market is thus positioned to grow as institutions prioritize security and compliance with stringent regulations. The integration of biometric systems not only mitigates risks but also fosters a safer banking environment, appealing to consumers who are increasingly aware of cybersecurity threats.

Government Initiatives and Support

Government initiatives in South Korea are playing a crucial role in shaping the biometric banking market. The South Korean government has been actively promoting the adoption of biometric technologies to enhance security and streamline banking processes. Policies aimed at encouraging innovation in financial technology are likely to foster a conducive environment for the growth of the biometric banking market. As of 2025, government support is expected to include funding for research and development in biometric solutions, as well as regulatory frameworks that facilitate their implementation. This backing not only boosts investor confidence but also encourages financial institutions to adopt biometric systems. Consequently, the biometric banking market is poised for growth as government initiatives align with the needs of the banking sector, creating a synergy that benefits both consumers and financial institutions.

Consumer Demand for Enhanced Security

The biometric banking market in South Korea is propelled by a growing consumer demand for enhanced security in financial transactions. As individuals become more aware of the risks associated with online banking, they are increasingly seeking solutions that offer greater protection. Surveys indicate that approximately 65% of South Korean consumers prefer biometric authentication methods over traditional passwords due to their perceived security benefits. This trend is influencing banks to invest in biometric technologies to meet customer expectations and build trust. The biometric banking market is likely to expand as financial institutions respond to this demand by integrating advanced biometric solutions into their services. By prioritizing security, banks can not only attract new customers but also retain existing ones, thereby fostering long-term relationships in a competitive market.

Technological Advancements in Biometric Systems

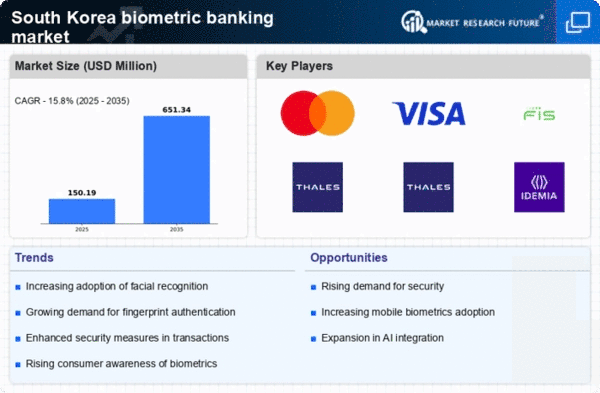

The biometric banking market in South Korea is experiencing a surge due to rapid technological advancements in biometric systems. Innovations such as facial recognition, fingerprint scanning, and iris recognition are becoming increasingly sophisticated, enhancing security measures for financial transactions. As of 2025, the market is projected to grow at a CAGR of approximately 15%, driven by the integration of artificial intelligence and machine learning in biometric solutions. These technologies not only improve accuracy but also reduce the time required for authentication, thereby streamlining banking processes. The increasing reliance on digital banking services further propels the demand for secure biometric solutions, as consumers seek to protect their financial information from cyber threats. Consequently, the biometric banking market is likely to expand significantly as banks and financial institutions adopt these advanced technologies to meet customer expectations and regulatory requirements.

Integration of Biometric Solutions in Mobile Banking

The integration of biometric solutions in mobile banking is a key driver for the biometric banking market in South Korea. With the increasing prevalence of smartphones and mobile banking applications, financial institutions are leveraging biometric technologies to enhance user experience and security. As of 2025, it is projected that over 80% of mobile banking apps in South Korea will incorporate biometric authentication features, such as fingerprint and facial recognition. This trend reflects a broader shift towards digital banking, where convenience and security are paramount. The biometric banking market is likely to benefit from this integration, as consumers favor seamless and secure access to their financial services. By adopting biometric solutions, banks can not only improve customer satisfaction but also reduce the risk of fraud, thereby solidifying their position in a competitive landscape.