Consumer Demand for Convenience

In Mexico, the biometric banking market is being driven by a growing consumer demand for convenience in financial transactions. As customers increasingly seek seamless and efficient banking experiences, biometric solutions such as fingerprint and facial recognition are gaining traction. These technologies allow for quick and secure access to banking services, reducing the time spent on traditional authentication methods. Recent surveys indicate that approximately 70% of Mexican consumers prefer biometric authentication over traditional passwords, highlighting a significant shift in user preferences. This demand for convenience is likely to propel the biometric banking market forward, as banks strive to enhance customer satisfaction and loyalty through innovative solutions that streamline the banking experience.

Increasing Cybersecurity Threats

The biometric banking market in Mexico is experiencing a surge in demand due to escalating cybersecurity threats. As financial institutions face sophisticated cyberattacks, the need for robust security measures becomes paramount. Biometric authentication offers a unique solution, as it relies on individual physical characteristics, making unauthorized access significantly more challenging. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting banks in Mexico to invest heavily in biometric technologies. This trend indicates a shift towards more secure banking practices, as institutions seek to protect sensitive customer data and maintain trust. Consequently, the biometric banking market is likely to expand as banks prioritize security and compliance with regulations, thereby enhancing their overall operational resilience.

Regulatory Compliance and Standards

The biometric banking market in Mexico is also influenced by the need for regulatory compliance and adherence to industry standards. Financial institutions are required to implement stringent security measures to protect customer data and prevent fraud. Regulatory bodies are increasingly recognizing the importance of biometric authentication as a means to enhance security protocols. In 2025, it is anticipated that compliance with data protection regulations will drive a significant portion of investments in biometric technologies. This regulatory landscape encourages banks to adopt biometric solutions, as they not only fulfill compliance requirements but also enhance customer trust. Consequently, the biometric banking market is likely to see sustained growth as institutions align their security practices with regulatory expectations.

Technological Advancements in Biometric Systems

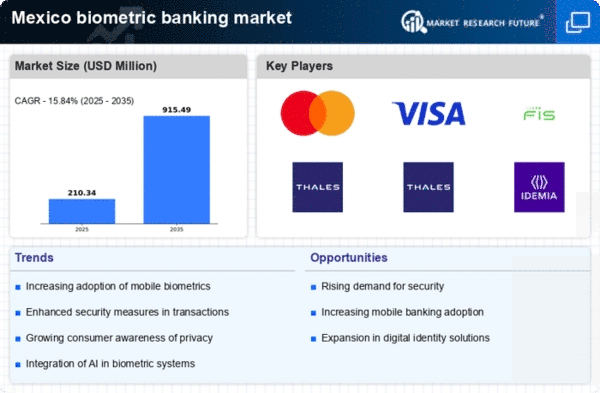

The biometric banking market in Mexico is benefiting from rapid technological advancements in biometric systems. Innovations in artificial intelligence and machine learning are enhancing the accuracy and efficiency of biometric authentication methods. For instance, the integration of AI algorithms allows for real-time analysis of biometric data, improving the speed and reliability of identity verification processes. As of 2025, the market for biometric technology is projected to reach $30 billion, with a substantial portion attributed to banking applications. This growth suggests that financial institutions in Mexico are increasingly adopting advanced biometric solutions to stay competitive and meet evolving customer expectations. The continuous evolution of technology is likely to further drive the adoption of biometric banking solutions, positioning them as a cornerstone of modern banking.

Competitive Pressure Among Financial Institutions

The competitive landscape of the banking sector in Mexico is another driver of the biometric banking market. As financial institutions strive to differentiate themselves and attract customers, the adoption of innovative technologies becomes essential. Biometric authentication offers a unique selling proposition, enabling banks to provide enhanced security and convenience. In a market where customer loyalty is increasingly difficult to secure, institutions that implement biometric solutions may gain a competitive edge. This competitive pressure is likely to accelerate the adoption of biometric banking technologies, as banks seek to enhance their service offerings and improve customer retention. The biometric banking market is expected to flourish as institutions respond to these competitive dynamics.