Top Industry Leaders in the Trade Surveillance Systems Market

Competitive Landscape of Trade Surveillance Systems Market

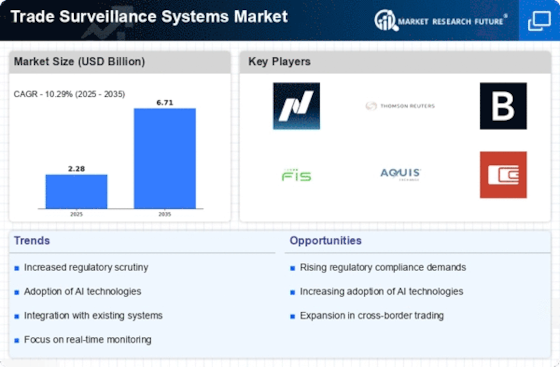

The global trade surveillance systems market is experiencing significant growth, driven by the increasing regulatory pressure on financial institutions to monitor and prevent market manipulation, insider trading, and other financial crimes. This has created a dynamic and competitive landscape, where established players are vying for market share with new and emerging companies.

Key players:

- Nasdaq, Inc. (Israel)

- FIS (Fidelity National Information Services, Inc.) (US)

- NICE Ltd (Israel)

- OneMarketData (US)

- ACA Compliance Group (US)

Strategies adopted:

- Product innovation: Market leaders are constantly innovating their solutions to address new regulatory requirements, detect emerging trading patterns, and improve their systems' efficiency and accuracy. This includes investments in artificial intelligence, machine learning, and big data analytics.

- Strategic partnerships: Many companies are forming partnerships with other technology providers, such as data analytics companies and regulatory compliance experts, to enhance their solutions and offer more comprehensive services.

- Market expansion: Established players are expanding their geographic reach through acquisitions and partnerships, while new and emerging companies are focusing on specific regions or niches.

- Cloud-based solutions: As mentioned before, cloud-based solutions are becoming increasingly popular due to their ease of deployment and scalability. Companies are offering their solutions as SaaS or are migrating their existing solutions to the cloud.

Factors for market share analysis:

- Market share: This is the percentage of the total market revenue held by a particular company.

- Customer base: The number and type of customers a company has is a good indicator of its market penetration.

- Product portfolio: The breadth and depth of a company's product portfolio can give insights into its capabilities and target markets.

- Financial performance: A company's financial performance can reveal its growth potential and stability.

- Technology and innovation: The level of investment a company makes in technology and innovation can indicate its commitment to staying ahead of the competition.

- Customer satisfaction: Customer satisfaction surveys and reviews can provide valuable insights into a company's reputation and the quality of its services.

New and emerging companies:

Several new and emerging companies are entering the trade surveillance market, bringing fresh ideas and innovative solutions. Some examples include:

- KRM22 (AI-powered trade surveillance)

- Verodin (cybersecurity for financial institutions)

- Quantifind (regulatory compliance and risk management)

- Accuity (KYC and sanctions screening)

These companies are often more agile and adaptable than large established vendors, and they are able to quickly respond to changing market demands.

Current company investment trends:

- AI and machine learning: Companies are investing heavily in AI and machine learning to improve their systems' ability to detect suspicious trading patterns and reduce false positives.

- Cloud-based solutions: The cloud is becoming the preferred deployment model for trade surveillance systems, and companies are investing in developing and migrating their solutions to the cloud.

- Data analytics: Companies are investing in data analytics tools and expertise to gain valuable insights from their trade surveillance data and improve their decision-making processes.

- Regulatory compliance: Companies are investing in solutions that help them comply with the latest regulatory requirements, such as MiFID II and Dodd-Frank.

- Cybersecurity: Companies are investing in cybersecurity measures to protect their systems from cyberattacks, which are a growing threat to financial institutions.

Latest Company Updates:

June 2023 - SET or the Stock Exchange of Thailand has unveiled its latest trading system along with market surveillance systems and market data distribution, based on the Nasdaq technology. This solution aims in supporting the rising transaction volumes and assorted investment products, while also improving the market’s integrity and trust. Besides, it has been designed in boosting efficiency and allowing faster order management. In fact, this implementation marks a major milestone in the constant development of the advanced Thai capital market. This technology uses Pre-trade risk management service, index calculation technology, and the market surveillance technology of Nasdaq.

May 2023 - PSX or Pakistan Stock Exchange has formally introduced their new trading and surveillance system, NTS that has 105 reports and 86 real-time alerts with 100,000 trades per second processing speed. This is a cutting edge, state of the art, and highly advanced system with low latency and high scalability and reliability features. The scientific monitoring indicator system here has about five sets of intelligent analysis indicators and 130 synthetic alerts. The intelligent analysis function allows high frequency time series matching, multi-dimensional analysis, trade replay, market manipulating intelligent screening, and front-running identification.

September 2023 - Eventus, a worldwide name in the trade surveillance software lately has unveiled an advanced UI for their popular Validus platform. The key drive behind the release is in ensuring a more efficient, smoother user experience, coupled with augmented transparency and extensive case-building features. Customers will find these latest features intuitive and easy to use and will also appreciate the worth this adds to their day-to-day use of this platform.