Increasing Regulatory Scrutiny

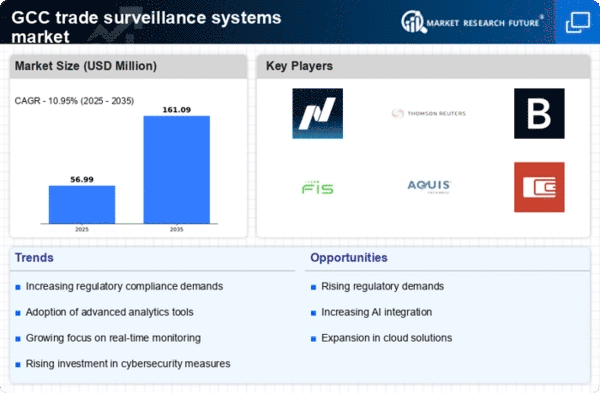

The trade surveillance-systems market is experiencing heightened regulatory scrutiny across the GCC region. Regulatory bodies are implementing stricter compliance requirements to combat financial crimes, including money laundering and insider trading. This trend is evident as financial institutions are mandated to adopt advanced surveillance systems to monitor trading activities effectively. The market was projected to grow at a CAGR of 12% from 2025 to 2030, driven by the need for compliance with these evolving regulations. As a result, organizations are investing in sophisticated trade surveillance solutions to ensure adherence to legal standards, thereby enhancing their operational integrity and reputation.

Rising Demand for Real-Time Monitoring

In the trade surveillance-systems market, there is a growing demand for real-time monitoring capabilities. Financial institutions in the GCC are increasingly recognizing the importance of immediate detection of suspicious trading activities. This shift is largely influenced by the need to mitigate risks associated with market manipulation and fraud. The market is expected to reach a valuation of $500 million by 2026, reflecting a robust growth trajectory. Real-time monitoring systems enable organizations to respond swiftly to potential threats, thereby safeguarding their assets and maintaining investor confidence. Consequently, the integration of advanced analytics and machine learning technologies is becoming a focal point for market players.

Technological Integration and Innovation

The trade surveillance-systems market is witnessing a surge in technological integration and innovation. Financial institutions are increasingly adopting artificial intelligence (AI) and machine learning (ML) to enhance their surveillance capabilities. These technologies facilitate the analysis of vast amounts of trading data, enabling organizations to identify patterns and anomalies more effectively. The market is projected to grow by 15% annually as firms seek to leverage these advancements to improve their operational efficiency. Moreover, the integration of cloud-based solutions is becoming prevalent, allowing for scalable and flexible surveillance systems that can adapt to the dynamic regulatory landscape in the GCC.

Expansion of Financial Markets in the GCC

The expansion of financial markets in the GCC is a critical driver for the trade surveillance-systems market. As new financial instruments and trading platforms emerge, the complexity of monitoring trading activities increases. This growth necessitates the implementation of advanced surveillance systems to ensure compliance and mitigate risks. The market is expected to grow to $600 million by 2027, reflecting the increasing need for effective monitoring solutions. Additionally, the rise of fintech companies in the region is further propelling the demand for innovative trade surveillance technologies, as these firms seek to establish credibility and trust among their clients.

Growing Awareness of Financial Crime Risks

There is a notable increase in awareness regarding financial crime risks within the trade surveillance-systems market. Organizations in the GCC are becoming more cognizant of the potential repercussions of failing to detect fraudulent activities. This awareness is driving investments in comprehensive surveillance systems that can provide robust protection against various forms of market abuse. The market is anticipated to expand significantly, with a projected growth rate of 10% over the next five years. As firms prioritize risk management and compliance, the demand for effective trade surveillance solutions is likely to rise, prompting vendors to innovate and enhance their offerings.