Increasing Regulatory Scrutiny

The trade surveillance-systems market in Germany is experiencing heightened regulatory scrutiny, driven by the need for compliance with stringent financial regulations. Regulatory bodies are imposing more rigorous standards on financial institutions, necessitating the implementation of advanced surveillance systems to monitor trading activities. This trend is underscored by the European Union's Markets in Financial Instruments Directive II (MiFID II), which mandates comprehensive transaction reporting and monitoring. As a result, financial firms are compelled to invest in sophisticated trade surveillance solutions to ensure adherence to these regulations. The market is projected to grow as institutions seek to mitigate risks associated with non-compliance, which can lead to substantial fines and reputational damage. Consequently, the increasing regulatory scrutiny is a significant driver for the trade surveillance-systems market, pushing firms to adopt more robust monitoring technologies.

Enhanced Focus on Data Security

The trade surveillance-systems market in Germany is witnessing an enhanced focus on data security, driven by the increasing threats of cyberattacks and data breaches. Financial institutions are under pressure to protect sensitive trading data and ensure the integrity of their surveillance systems. This concern is amplified by regulatory requirements that mandate robust data protection measures. As a result, firms are investing in advanced surveillance technologies that not only monitor trading activities but also safeguard against potential cyber threats. The market is expected to grow as institutions prioritize the implementation of comprehensive security protocols within their trade surveillance systems. This focus on data security is crucial for maintaining customer trust and compliance with regulatory standards, making it a significant driver for the trade surveillance-systems market.

Growing Demand for Real-Time Monitoring

The demand for real-time monitoring solutions is a prominent driver in the trade surveillance-systems market in Germany. Financial institutions are increasingly recognizing the importance of immediate detection and response to suspicious trading activities. This shift is largely influenced by the need to comply with regulatory mandates that require timely reporting of anomalies. As a result, firms are investing in systems that provide real-time analytics and alerts, enabling them to act swiftly to mitigate potential risks. The market for trade surveillance systems is projected to grow as institutions prioritize the implementation of real-time monitoring capabilities to enhance their compliance efforts. This trend reflects a broader movement towards proactive risk management in the financial sector, where the ability to monitor trades in real-time is becoming essential for maintaining market integrity.

Rising Incidences of Market Manipulation

The trade surveillance-systems market is being propelled by the rising incidences of market manipulation in Germany. As financial markets become more complex and interconnected, the potential for fraudulent activities such as insider trading and spoofing has escalated. This has led to a growing demand for effective surveillance systems that can detect and prevent such illicit activities. According to recent data, the financial sector in Germany has reported a notable increase in suspicious trading activities, prompting regulators to enhance their oversight capabilities. Consequently, financial institutions are investing in advanced trade surveillance technologies to safeguard their operations and maintain market integrity. The need to protect against market manipulation is thus a critical driver for the trade surveillance-systems market, as firms strive to enhance their compliance frameworks and ensure transparent trading practices.

Technological Integration and Innovation

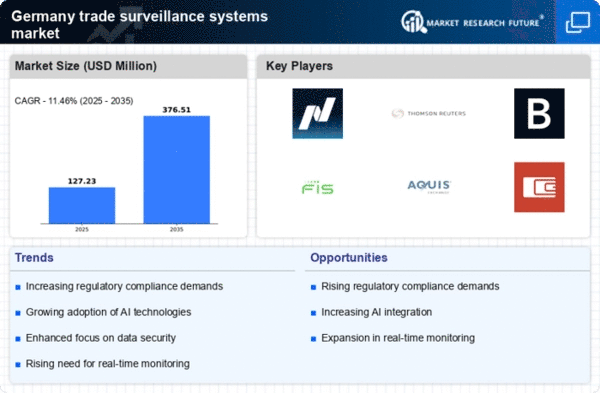

Technological integration and innovation are vital drivers of the trade surveillance-systems market in Germany. The rapid advancement of technologies such as artificial intelligence (AI) and machine learning (ML) is transforming how financial institutions monitor trading activities. These technologies enable firms to analyze vast amounts of data in real-time, enhancing their ability to detect anomalies and potential compliance breaches. The trade surveillance-systems market is witnessing a shift towards more automated and intelligent solutions, which can significantly reduce the time and resources required for manual monitoring. As institutions increasingly adopt these innovative technologies, the market is expected to expand, with a projected growth rate of approximately 15% annually over the next few years. This technological evolution is crucial for firms aiming to stay ahead in a competitive landscape while ensuring compliance with regulatory requirements.