Rising Cybersecurity Concerns

The trade surveillance-systems market is increasingly shaped by rising cybersecurity concerns, as financial institutions face growing threats from cybercriminals. In 2025, it is estimated that cyberattacks targeting financial services in Canada will increase by 20%, prompting organizations to invest in more secure surveillance systems. This trend highlights the need for robust cybersecurity measures within trade surveillance frameworks to protect sensitive data and maintain trust with clients. As firms seek to safeguard their operations against potential breaches, the trade surveillance-systems market is likely to experience growth driven by the demand for enhanced security features and protocols.

Increasing Regulatory Scrutiny

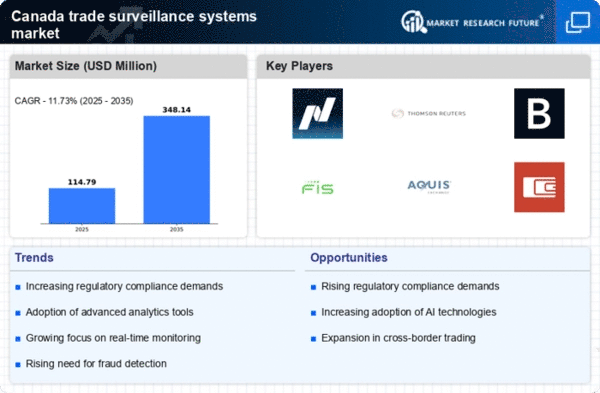

The trade surveillance-systems market in Canada is experiencing heightened regulatory scrutiny, compelling financial institutions to adopt robust surveillance solutions. Regulatory bodies are enforcing stricter compliance measures, which necessitate the implementation of advanced monitoring systems. In 2025, the Canadian Securities Administrators reported a 15% increase in compliance-related audits, indicating a growing demand for effective trade surveillance systems. This trend is likely to drive investments in technology that can ensure adherence to regulations, thereby enhancing the overall integrity of the financial markets. As firms strive to avoid hefty fines and reputational damage, the trade surveillance-systems market is poised for growth, with organizations prioritizing compliance as a key driver of their operational strategies.

Focus on Operational Efficiency

Operational efficiency is becoming a critical focus for organizations within the trade surveillance-systems market. As firms strive to streamline their processes and reduce costs, there is a growing emphasis on implementing systems that enhance productivity. In 2025, it is anticipated that 30% of Canadian financial institutions will prioritize operational efficiency in their surveillance strategies. This focus may lead to the adoption of integrated platforms that consolidate various surveillance functions, thereby minimizing redundancies and improving response times. By enhancing operational efficiency, organizations can not only reduce costs but also improve their ability to detect and respond to suspicious activities, thereby strengthening their overall compliance posture.

Growing Demand for Data Analytics

The trade surveillance-systems market is increasingly influenced by the growing demand for data analytics capabilities. Financial institutions in Canada are recognizing the value of data-driven decision-making, prompting investments in sophisticated analytics tools. In 2025, it is projected that the market for data analytics in trade surveillance will expand by 25%, driven by the need for enhanced risk assessment and fraud detection. This trend indicates a shift towards more proactive surveillance strategies, where organizations utilize analytics to identify patterns and trends in trading behavior. As firms aim to optimize their operations and mitigate risks, the trade surveillance-systems market is likely to see a corresponding rise in the adoption of advanced analytics solutions.

Technological Integration and Innovation

The trade surveillance-systems market is witnessing a surge in technological integration, as firms increasingly leverage innovative solutions to enhance their surveillance capabilities. The adoption of artificial intelligence (AI) and machine learning (ML) technologies is transforming the landscape, enabling more efficient data analysis and anomaly detection. In 2025, it is estimated that 40% of Canadian financial institutions will implement AI-driven surveillance systems, reflecting a significant shift towards automation. This integration not only improves the accuracy of trade monitoring but also reduces operational costs. As organizations seek to stay competitive, the trade surveillance-systems market is likely to benefit from ongoing technological advancements that facilitate real-time insights and proactive risk management.