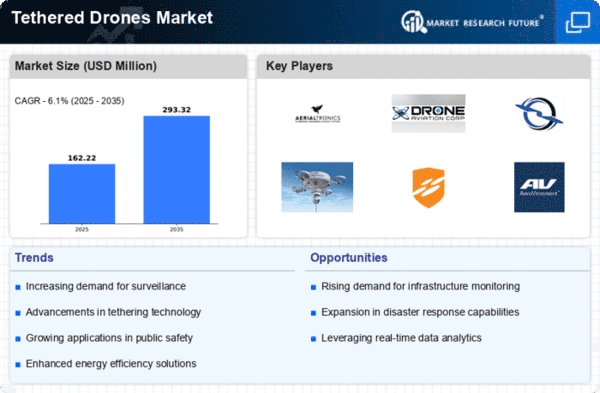

The Tethered Drones Market is currently characterized by a dynamic competitive landscape, driven by advancements in technology and increasing demand for surveillance and communication solutions. Key players such as Aerialtronics (NL), Drone Aviation Holding Corp (US), and Elistair (FR) are strategically positioning themselves through innovation and partnerships. Aerialtronics (NL) focuses on enhancing its drone capabilities for public safety applications, while Drone Aviation Holding Corp (US) emphasizes military and defense applications, indicating a diverse operational focus among these companies. Collectively, their strategies contribute to a moderately fragmented market, where innovation and specialized applications are pivotal for competitive advantage.In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain efficiency. The market structure appears moderately fragmented, with several players vying for market share. This fragmentation allows for niche players to thrive, while larger companies leverage their resources to optimize supply chains and expand their operational footprints. The collective influence of these key players shapes the market dynamics, fostering an environment where innovation is crucial for maintaining competitiveness.

In November Elistair (FR) announced a partnership with a leading telecommunications provider to integrate its tethered drone technology into urban infrastructure projects. This strategic move is likely to enhance Elistair's market presence and facilitate the deployment of drones for real-time data collection and surveillance in smart city initiatives. Such collaborations may signify a shift towards more integrated solutions that combine drone technology with existing urban frameworks.

In October Drone Aviation Holding Corp (US) secured a contract with the Department of Defense to supply tethered drones for surveillance operations. This contract not only underscores the company's stronghold in the defense sector but also highlights the increasing reliance on tethered drones for critical military applications. The strategic importance of this contract may bolster the company's revenue streams and enhance its reputation as a key player in defense technology.

In September Aerialtronics (NL) launched a new line of tethered drones specifically designed for emergency response scenarios. This product launch reflects the company's commitment to innovation and its focus on addressing the needs of public safety agencies. By diversifying its product offerings, Aerialtronics may strengthen its competitive position and appeal to a broader customer base.

As of December current trends in the Tethered Drones Market indicate a strong emphasis on digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the competitive landscape, as companies seek to leverage complementary strengths to enhance their offerings. The evolution of competitive differentiation appears to be shifting from price-based competition towards innovation, technology, and supply chain reliability. This transition suggests that companies that prioritize technological advancements and strategic partnerships are likely to thrive in the evolving market.