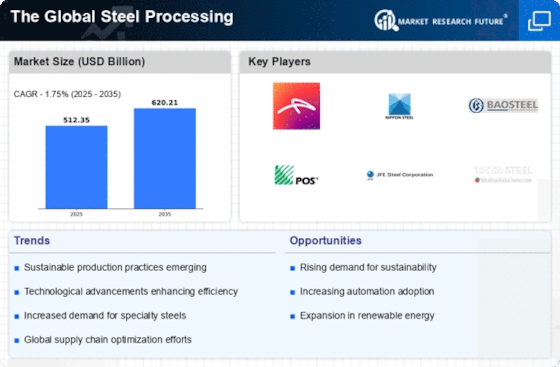

Rising Demand for Steel Products

The increasing demand for steel products across various sectors, including construction, automotive, and manufacturing, drives The Global Steel Processing Industry. In recent years, the construction sector has experienced substantial growth, with steel being a primary material for infrastructure projects. For instance, the demand for steel in construction is projected to reach approximately 1.6 billion tons by 2025. This surge in demand is attributed to urbanization and population growth, which necessitate the development of residential and commercial buildings. Additionally, the automotive industry is shifting towards lightweight steel solutions to enhance fuel efficiency, further propelling the market. As a result, The Global Steel Processing Industry is likely to witness robust growth, driven by these diverse applications.

Geopolitical Factors and Trade Policies

Geopolitical factors and trade policies play a crucial role in shaping The Global Steel Processing Industry. Trade agreements and tariffs can significantly influence steel prices and availability, impacting manufacturers and consumers alike. For instance, recent trade tensions have led to fluctuations in steel imports and exports, affecting market dynamics. Countries are increasingly focusing on self-sufficiency in steel production to mitigate risks associated with global supply chains. This shift may lead to increased domestic production capacities, thereby altering the competitive landscape of The Global Steel Processing Industry. Understanding these geopolitical influences is essential for stakeholders to navigate the complexities of the market effectively.

Innovations in Steel Processing Technologies

Technological advancements in steel processing are transforming The Global Steel Processing Industry. Innovations such as automation, artificial intelligence, and advanced manufacturing techniques are enhancing efficiency and reducing production costs. For example, the adoption of Industry 4.0 technologies allows for real-time monitoring and optimization of production processes, leading to increased output and reduced waste. Furthermore, the integration of smart technologies enables manufacturers to produce high-quality steel products that meet stringent industry standards. As these technologies continue to evolve, they are expected to play a crucial role in shaping the future of The Global Steel Processing Industry, potentially leading to higher profitability and competitiveness.

Sustainability and Environmental Regulations

The growing emphasis on sustainability and stringent environmental regulations significantly impacts The Global Steel Processing Industry. Governments and organizations are increasingly prioritizing eco-friendly practices, prompting steel manufacturers to adopt greener production methods. For instance, the implementation of carbon capture and storage technologies is becoming more prevalent, aiming to reduce greenhouse gas emissions associated with steel production. Additionally, the recycling of steel is gaining traction, with recycled steel accounting for nearly 30% of global steel production. This shift towards sustainable practices not only aligns with regulatory requirements but also appeals to environmentally conscious consumers, thereby enhancing the market's growth potential.

Global Economic Growth and Infrastructure Development

Economic growth and infrastructure development are pivotal drivers of The Global Steel Processing Industry. As economies expand, the demand for steel in infrastructure projects, such as roads, bridges, and railways, increases significantly. According to recent estimates, global infrastructure spending is expected to reach over 3 trillion dollars by 2025, creating substantial opportunities for steel manufacturers. Emerging economies, in particular, are investing heavily in infrastructure to support urbanization and industrialization. This trend is likely to bolster the demand for processed steel products, thereby fueling the growth of The Global Steel Processing Industry. The correlation between economic development and steel demand underscores the industry's vital role in supporting global progress.