Adoption of IoT Technologies

The proliferation of Internet of Things (IoT) devices is significantly influencing the Event Stream Processing Market Industry. As more devices become interconnected, the volume of data generated is escalating rapidly. This influx of data necessitates robust event stream processing solutions to manage, analyze, and derive actionable insights from the continuous streams of information. Industries such as manufacturing, healthcare, and smart cities are particularly impacted, as they rely on real-time data to optimize operations and improve service delivery. The integration of IoT with event stream processing is expected to drive market growth, with forecasts suggesting that the number of connected devices will reach over 30 billion by 2030. Consequently, the Event Stream Processing Market Industry is likely to see increased investments in technologies that facilitate the seamless processing of data from diverse IoT sources.

Growth of Big Data Technologies

The rapid advancement of big data technologies is a key driver of the Event Stream Processing Market Industry. As organizations accumulate vast amounts of data, the need for efficient processing and analysis becomes paramount. Event stream processing serves as a critical component in the big data ecosystem, enabling real-time analysis of large data sets. This capability is essential for businesses seeking to derive insights from data at unprecedented speeds. Market projections suggest that the big data analytics market will exceed 200 billion dollars by 2025, further underscoring the importance of event stream processing in managing and analyzing big data. As companies increasingly adopt big data solutions, the Event Stream Processing Market Industry is expected to witness significant growth, driven by the demand for technologies that can handle the complexities of large-scale data processing.

Need for Enhanced Customer Experience

In the current competitive landscape, businesses are increasingly focused on enhancing customer experience, which is driving the Event Stream Processing Market Industry. Organizations are leveraging event stream processing to analyze customer interactions in real-time, enabling them to tailor services and products to meet evolving consumer preferences. This approach not only improves customer satisfaction but also fosters loyalty and retention. Market data indicates that companies utilizing real-time analytics can achieve up to a 20% increase in customer engagement. As businesses strive to differentiate themselves, the demand for solutions that facilitate real-time insights into customer behavior is expected to rise. This trend underscores the critical role of event stream processing in shaping customer-centric strategies, thereby propelling the growth of the Event Stream Processing Market Industry.

Regulatory Compliance and Data Governance

The increasing emphasis on regulatory compliance and data governance is shaping the Event Stream Processing Market Industry. Organizations are required to adhere to stringent regulations regarding data privacy and security, which necessitates the implementation of effective data management practices. Event stream processing solutions enable businesses to monitor data flows in real-time, ensuring compliance with regulations such as GDPR and CCPA. This capability is particularly vital for industries such as finance and healthcare, where data breaches can have severe consequences. As regulatory frameworks continue to evolve, the demand for event stream processing technologies that facilitate compliance is likely to grow. This trend not only enhances data security but also instills consumer confidence, thereby contributing to the overall expansion of the Event Stream Processing Market Industry.

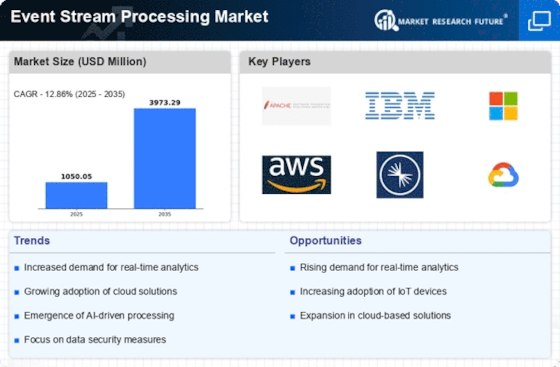

Increasing Demand for Real-Time Data Processing

The Event Stream Processing Market Industry is experiencing a notable surge in demand for real-time data processing solutions. Organizations across various sectors are increasingly recognizing the value of immediate insights derived from streaming data. This trend is driven by the need for timely decision-making, particularly in industries such as finance, telecommunications, and e-commerce. According to recent estimates, the market for real-time analytics is projected to grow at a compound annual growth rate of over 25% in the coming years. This growth is indicative of a broader shift towards data-driven strategies, where businesses leverage event stream processing to enhance operational efficiency and customer engagement. As a result, the Event Stream Processing Market Industry is poised for substantial expansion, with companies investing in advanced technologies to harness the power of real-time data.