Market Analysis

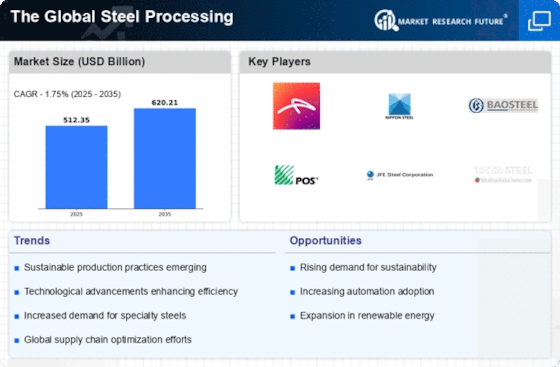

Global Steel Processing Market (Global, 2024)

Introduction

The Global Steel Processing Market is poised to undergo significant transformations driven by evolving industrial demands, technological advancements, and sustainability initiatives. As industries increasingly prioritize efficiency and environmental responsibility, the steel processing sector is adapting to meet these challenges through innovative practices and enhanced production techniques. The integration of automation and digital technologies is reshaping traditional processing methods, enabling manufacturers to optimize operations and reduce waste. Furthermore, the growing emphasis on recycling and the use of alternative materials is influencing market dynamics, as stakeholders seek to align with global sustainability goals. This report delves into the intricate landscape of the steel processing market, examining key trends, competitive strategies, and the implications of regulatory frameworks that are shaping the future of this vital industry.

PESTLE Analysis

- Political

- In 2024, the global steel processing market is heavily influenced by government policies aimed at reducing carbon emissions. For instance, the European Union has set a target to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, which directly impacts steel production methods. Additionally, the U.S. government has proposed a $1.2 billion investment in advanced steel manufacturing technologies to promote sustainable practices, reflecting a political push towards greener steel processing.

- Economic

- The global steel processing market is projected to be affected by fluctuating raw material prices, particularly iron ore, which averaged $120 per metric ton in early 2024. This price volatility is driven by supply chain disruptions and geopolitical tensions, particularly in regions like Australia and Brazil, which are major exporters. Furthermore, the global inflation rate is estimated at 4.5% in 2024, impacting operational costs and pricing strategies within the steel processing sector.

- Social

- Public awareness regarding sustainability and environmental impact is rising, with 70% of consumers in a recent survey indicating a preference for products made from recycled steel. This shift in consumer behavior is prompting steel processors to adopt more sustainable practices, such as increasing the use of electric arc furnaces, which can reduce carbon emissions by up to 75% compared to traditional blast furnaces. The growing demand for eco-friendly products is reshaping market dynamics and influencing production strategies.

- Technological

- Technological advancements are playing a crucial role in the steel processing market, with investments in automation and artificial intelligence expected to reach $500 million in 2024. These technologies enhance operational efficiency and reduce waste, with companies increasingly adopting smart manufacturing techniques. For example, the implementation of IoT devices in steel mills can lead to a 20% increase in productivity by optimizing resource allocation and minimizing downtime.

- Legal

- In 2024, the steel processing industry faces stringent regulations regarding emissions and waste management. The U.S. Environmental Protection Agency (EPA) has introduced new regulations that require steel manufacturers to reduce particulate matter emissions by 30% by 2025. Compliance with these legal frameworks necessitates significant investment in cleaner technologies, with estimates suggesting that companies may need to allocate up to $200 million for compliance-related upgrades and modifications.

- Environmental

- Environmental concerns are increasingly shaping the steel processing market, with the World Steel Association reporting that the industry is responsible for approximately 7% of global CO2 emissions. In response, many companies are committing to carbon neutrality by 2050, with an estimated $1 trillion needed for the transition to low-carbon technologies. Additionally, the push for circular economy practices is leading to a rise in the recycling rate of steel, which reached 85% in 2024, highlighting the industry's efforts to mitigate its environmental impact.

Porter's Five Forces

- Threat of New Entrants

- Medium - The global steel processing market has moderate barriers to entry, including significant capital investment, access to technology, and established distribution networks. While new entrants can emerge, they face challenges in competing with established players who have economies of scale and brand loyalty.

- Bargaining Power of Suppliers

- Medium - Suppliers in the steel processing market have a moderate level of bargaining power. While there are numerous suppliers of raw materials, the concentration of key inputs can give certain suppliers leverage. However, the availability of alternative materials and the ability of processors to switch suppliers can mitigate this power.

- Bargaining Power of Buyers

- High - Buyers in the steel processing market wield significant bargaining power due to the availability of multiple suppliers and the commoditized nature of steel products. Large-scale buyers, such as automotive and construction companies, can negotiate favorable terms, impacting profit margins for processors.

- Threat of Substitutes

- Medium - The threat of substitutes in the steel processing market is moderate. While there are alternative materials such as aluminum and composites, steel remains a preferred choice for many applications due to its strength, durability, and cost-effectiveness. However, advancements in substitute materials could pose a future threat.

- Competitive Rivalry

- High - The competitive rivalry in the global steel processing market is high, characterized by numerous players competing on price, quality, and innovation. The market is fragmented, with both large multinational corporations and smaller regional firms vying for market share, leading to aggressive competition and price wars.

SWOT Analysis

Strengths

- Established global supply chains and distribution networks.

- Technological advancements in steel processing techniques.

- Strong demand from construction and automotive industries.

Weaknesses

- High energy consumption and environmental impact.

- Dependence on raw material prices and availability.

- Limited diversification in product offerings.

Opportunities

- Growing demand for sustainable and recycled steel products.

- Expansion into emerging markets with increasing infrastructure needs.

- Investment in automation and smart manufacturing technologies.

Threats

- Intense competition from low-cost producers in developing countries.

- Regulatory pressures regarding emissions and sustainability.

- Volatility in raw material prices due to geopolitical tensions.

Summary

The Global Steel Processing Market in 2024 is characterized by strong demand driven by key industries, bolstered by technological advancements. However, the market faces challenges such as high energy consumption and reliance on raw material prices. Opportunities for growth lie in the shift towards sustainable practices and expansion into emerging markets, while threats include competition from low-cost producers and regulatory pressures. Strategic focus on innovation and sustainability will be crucial for companies to navigate these dynamics effectively.

Leave a Comment