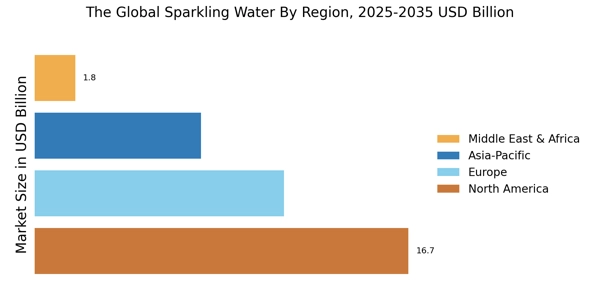

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World, with detailed coverage including the sparkling water market in India as part of the Asia-Pacific analysis. The Europe sparkling water market accounted for USD 33.1 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. This is attributed to the growing incidence of sparkling water products such as La Croix, Perrier Mineral, Bubbly Sparkling, Hal, Gerolsteiner, and Sparkling ICE and an aging population across the region.

Further, the significant countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

North America, sparkling water market, accounts for the second-largest market share due to the availability of sparkling water has many technological advantages including the improvement of flavors, development of citric acid and carbonated water. Further, the German sparkling water market held the largest market share, and the UK sparkling water market was the fastest-growing market in the European region.

The Asia-Pacific sparkling water Market is expected to grow at the fastest CAGR from 2022 to 2030. This is due to the increase in their presence in an industry that is becoming increasingly competitive. They have released several new drinks and food products that are influenced by both national and international cuisines. The vast growth in the region is attributable to an older population that is growing along with rising water concerns and public awareness that have increased improvement of carbonated water quality use in the Asia Pacific region throughout the forecast period.

Moreover, China's sparkling water market held the largest market share, and the sparkling water market in India was the fastest-growing market in the Asia-Pacific region, supported by rising health awareness and increased domestic production.

For instance, the sparkling water market in India is emerging as a favored destination for sparkling water production, driven by increasing intake, improved digestion benefits, and growing consumer preference for healthier beverage alternatives. The tempo beverage Ltd (Israel) Group offers works excellent as a increased intake, and improved bone. It supports healthy drink sparkling water due to advantages like easier digestion and heart health. Moreover, it strengthens the water flavor stronger and promotes excellent sparkling water growth.

As per the data cited in the sparkling water companies 2022-21 published by the sparkling water producer Association in July 2022, Singapore is ranked in 2nd position, Japan at 3rd, India at 10th, South Korea at 14th, and China at 33rd out of the top 46 international wood vinegar production destinations. Hence, Asia-Pacific is anticipated to register the highest growth rate over the forecast period from 2022–2030.