Health Conscious Consumer Behavior

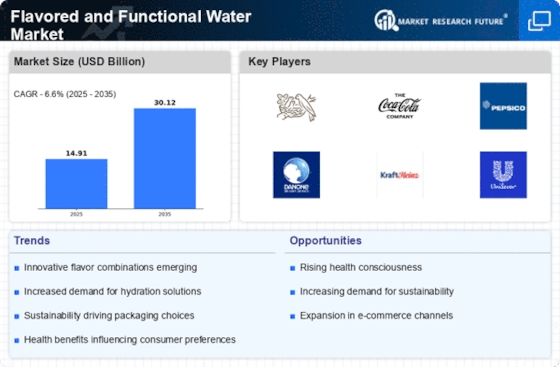

The flavored and functional water Market is experiencing a notable shift as consumers increasingly prioritize health and wellness in their purchasing decisions. This trend is evidenced by a growing demand for beverages that offer hydration along with added health benefits, such as vitamins, minerals, and electrolytes. According to recent data, the flavored water segment has seen a compound annual growth rate of approximately 10% over the past few years, indicating a robust market expansion. Consumers are gravitating towards products that not only quench thirst but also contribute to overall well-being. This shift is further fueled by the rise of fitness culture and the increasing awareness of the importance of hydration in maintaining a healthy lifestyle. As a result, brands within the Flavored and Functional Water Market are innovating to meet these evolving consumer preferences.

Flavor Diversification and Innovation

Flavor innovation plays a crucial role in driving growth within the Flavored and Functional Water Market. As consumer preferences evolve, brands are compelled to diversify their flavor offerings to capture a broader audience. The introduction of unique and exotic flavors, such as hibiscus, cucumber-mint, and tropical fruit blends, has become a strategic focus for many companies. Market data reveals that innovative flavors can lead to a 15% increase in sales, as consumers seek novel experiences in their beverage choices. This trend not only enhances consumer engagement but also fosters brand differentiation in a competitive landscape. As a result, the Flavored and Functional Water Market is likely to witness continued investment in flavor research and development, ensuring that brands remain relevant and appealing to adventurous consumers.

Sustainability and Eco-Friendly Packaging

Sustainability has emerged as a pivotal driver within the Flavored and Functional Water Market, as consumers become more environmentally conscious. The demand for eco-friendly packaging solutions is on the rise, with many brands adopting recyclable materials and reducing plastic usage. This shift aligns with broader environmental initiatives aimed at minimizing waste and promoting sustainable practices. Recent statistics indicate that nearly 60% of consumers are willing to pay a premium for products that utilize sustainable packaging. Consequently, companies in the Flavored and Functional Water Market are increasingly investing in sustainable practices, which not only appeal to eco-conscious consumers but also enhance brand loyalty. This trend suggests that sustainability is not merely a passing fad but a fundamental aspect of the market's evolution, influencing product development and marketing strategies.

Health Benefits and Functional Ingredients

The incorporation of functional ingredients into flavored water products is a key driver within the Flavored and Functional Water Market. Consumers are increasingly seeking beverages that offer more than just hydration; they desire products that provide health benefits, such as enhanced immunity, improved digestion, and increased energy levels. Ingredients like probiotics, antioxidants, and adaptogens are gaining traction, appealing to health-conscious consumers. Market Research Future indicates that products featuring functional ingredients can command higher price points, reflecting their perceived value. This trend suggests that brands within the Flavored and Functional Water Market must prioritize the development of products that not only taste good but also deliver tangible health benefits, thereby aligning with consumer expectations and preferences.

Increased Availability and Distribution Channels

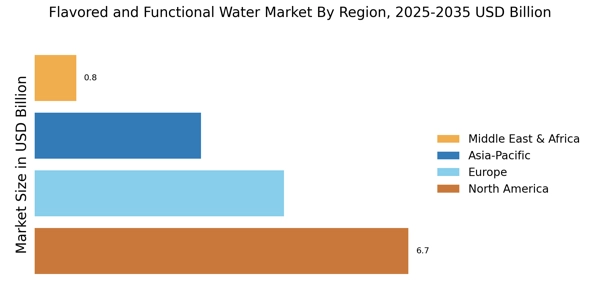

The expansion of distribution channels is a significant driver for the Flavored and Functional Water Market. As consumer demand rises, brands are increasingly focusing on enhancing product availability across various retail platforms, including supermarkets, convenience stores, and online marketplaces. Recent data indicates that e-commerce sales of flavored water have surged, accounting for nearly 25% of total sales in the sector. This shift towards online shopping reflects changing consumer behaviors and preferences, particularly among younger demographics. Consequently, companies are investing in logistics and partnerships to ensure their products are readily accessible to consumers. This increased availability not only boosts sales but also enhances brand visibility, positioning the Flavored and Functional Water Market for sustained growth in the coming years.