Support from Government Initiatives

Government initiatives in Spain play a crucial role in promoting the refurbished medical-devices market. Policies aimed at enhancing healthcare efficiency and reducing costs often include provisions for the use of refurbished equipment. Such support can manifest in the form of funding, incentives, or regulatory frameworks that facilitate the integration of refurbished devices into healthcare systems. The refurbished medical-devices market stands to gain from these initiatives, as they not only encourage healthcare providers to consider refurbished options but also help to establish standards that ensure quality and safety. This supportive environment may lead to a projected growth of 10% in the market as more facilities take advantage of government-backed programs.

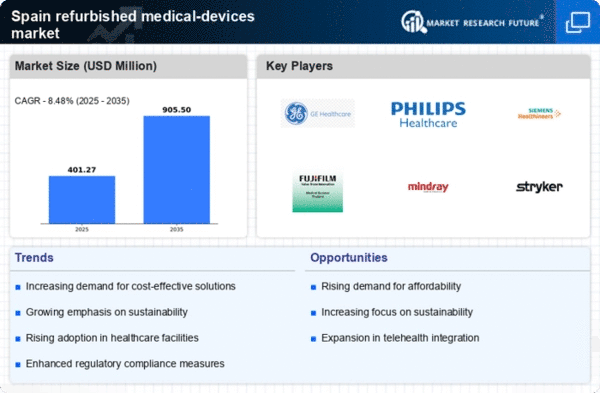

Rising Demand for Cost-Effective Solutions

The refurbished medical-devices market in Spain experiences a notable increase in demand due to the rising need for cost-effective healthcare solutions. Hospitals and clinics are increasingly seeking ways to manage budgets while maintaining high-quality patient care. The market for refurbished devices is projected to grow as healthcare providers recognize the potential savings, with estimates suggesting that refurbished devices can be up to 50% cheaper than new ones. This trend is particularly relevant in Spain, where healthcare budgets are under pressure. The refurbished medical-devices market is thus positioned to benefit from this shift towards more economical options, allowing facilities to allocate resources more efficiently while still ensuring access to essential medical technology.

Increased Focus on Healthcare Accessibility

The refurbished medical-devices market in Spain is significantly influenced by the growing emphasis on healthcare accessibility. As the population ages and the prevalence of chronic diseases rises, there is a pressing need for affordable medical equipment. Refurbished devices offer a viable solution, enabling healthcare facilities to provide necessary services without incurring prohibitive costs. Reports indicate that the refurbished medical-devices market could see a growth rate of approximately 15% annually as more institutions recognize the importance of making healthcare accessible to all segments of the population. This focus on accessibility aligns with broader public health goals, further driving the demand for refurbished medical devices.

Environmental Considerations and Waste Reduction

The refurbished medical-devices market in Spain is increasingly shaped by environmental considerations and the need for waste reduction. As awareness of sustainability grows, healthcare providers are more inclined to choose refurbished devices as a means to minimize their environmental footprint. The refurbishment process not only extends the life of medical equipment but also reduces waste generated from discarded devices. The refurbished medical-devices market is thus likely to benefit from this trend, as institutions seek to align their operations with sustainable practices. This shift could potentially lead to a 20% increase in the adoption of refurbished devices over the next few years, reflecting a broader commitment to environmental stewardship within the healthcare sector.

Technological Advancements in Refurbishment Processes

Advancements in refurbishment technologies significantly enhance the quality and reliability of refurbished medical devices. In Spain, the refurbishment process has evolved, incorporating sophisticated testing and quality assurance protocols that ensure devices meet stringent safety standards. This evolution not only boosts consumer confidence but also expands the range of devices available in the refurbished medical-devices market. As a result, healthcare providers are more inclined to invest in refurbished options, knowing they are acquiring reliable equipment. The refurbished medical-devices market is thus likely to see increased adoption rates as these technological improvements continue to emerge, further solidifying the market's position within the healthcare sector.