Regulatory Support and Standards

The refurbished medical-devices market benefits from evolving regulatory frameworks that support the refurbishment process. Regulatory bodies in the US are increasingly recognizing the importance of refurbished devices in enhancing healthcare access. For instance, guidelines that ensure quality and safety standards for refurbished equipment are being established, which may enhance consumer confidence. This regulatory support could lead to a more structured market environment, encouraging manufacturers and refurbishers to adhere to best practices. As a result, the refurbished medical-devices market is expected to see a rise in both supply and demand, as stakeholders become more assured of the quality and reliability of refurbished products.

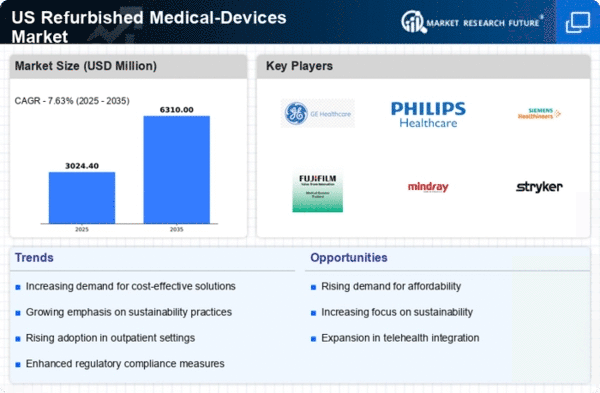

Rising Demand for Cost-Effective Solutions

The refurbished medical-devices market is experiencing a notable increase in demand as healthcare providers seek cost-effective solutions. With healthcare expenditures rising, institutions are compelled to optimize budgets while maintaining quality care. Refurbished devices often present a viable alternative, offering substantial savings, sometimes up to 50% compared to new equipment. This trend is particularly pronounced in smaller healthcare facilities that may lack the financial resources to invest in brand-new technology. As a result, the refurbished medical-devices market is likely to expand, driven by the need for affordable yet reliable medical equipment. Furthermore, the increasing acceptance of refurbished devices among healthcare professionals indicates a shift in perception, further bolstering market growth.

Increased Focus on Healthcare Accessibility

The refurbished medical-devices market is significantly influenced by the growing emphasis on healthcare accessibility. As healthcare systems strive to provide equitable access to medical services, refurbished devices emerge as a practical solution. They enable healthcare facilities, particularly in underserved areas, to acquire essential equipment without incurring prohibitive costs. This focus on accessibility aligns with broader healthcare initiatives aimed at improving patient outcomes. Consequently, the refurbished medical-devices market is likely to expand as more institutions recognize the role of refurbished equipment in bridging the gap in healthcare access, thereby enhancing service delivery.

Environmental Considerations and Waste Reduction

the refurbished medical-devices market is being increasingly shaped by environmental considerations and the need for waste reduction. As healthcare organizations become more aware of their environmental impact, the adoption of refurbished devices is seen as a sustainable practice. Refurbishing medical equipment not only extends the lifecycle of devices but also reduces electronic waste, which is a growing concern in the healthcare sector. This shift towards sustainability may drive demand for refurbished devices, as institutions seek to align with eco-friendly practices. The refurbished medical-devices market is thus positioned to benefit from this trend, as more healthcare providers prioritize environmental responsibility in their procurement strategies.

Technological Innovations in Refurbishment Processes

Technological advancements in refurbishment processes are playing a crucial role in the growth of the refurbished medical-devices market. Innovations such as automated testing and advanced sterilization techniques are enhancing the quality and reliability of refurbished devices. These improvements not only ensure compliance with safety standards but also increase the lifespan of refurbished equipment. As a result, healthcare providers are more inclined to invest in refurbished devices, knowing they meet stringent quality benchmarks. The integration of technology in refurbishment processes may also lead to reduced turnaround times, further appealing to healthcare facilities that require prompt access to medical equipment.