Increased Focus on Preventive Healthcare

The shift towards preventive healthcare in Japan is influencing the refurbished medical-devices market. As healthcare providers emphasize early diagnosis and treatment, the demand for diagnostic and monitoring equipment is rising. Refurbished devices, which can provide essential functionalities at lower costs, are becoming increasingly appealing to healthcare facilities aiming to expand their preventive care capabilities. This trend is likely to drive growth in the refurbished medical-devices market, as providers seek to invest in equipment that supports proactive health management without incurring prohibitive expenses. The market is expected to see a steady increase in demand for refurbished diagnostic tools and monitoring systems.

Regulatory Framework and Quality Assurance

The regulatory landscape in Japan plays a crucial role in shaping the refurbished medical-devices market. Stringent quality assurance standards ensure that refurbished devices meet safety and efficacy requirements, which is vital for gaining the trust of healthcare providers. The government has implemented guidelines that facilitate the refurbishment process while maintaining high quality. This regulatory support is likely to enhance the credibility of the refurbished medical-devices market, encouraging more healthcare facilities to consider these options. As awareness of the benefits of refurbished devices grows, the market is expected to expand, driven by a combination of regulatory compliance and the assurance of quality.

Rising Demand for Cost-Effective Solutions

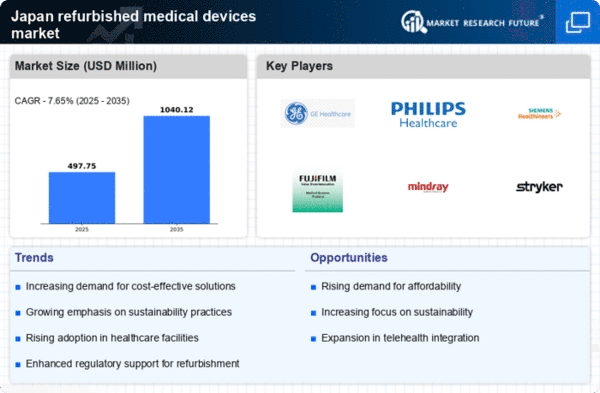

The increasing financial constraints faced by healthcare facilities in Japan drive the demand for cost-effective solutions, particularly in the refurbished medical-devices market. Hospitals and clinics are seeking ways to optimize their budgets while maintaining high-quality patient care. Refurbished devices offer a viable alternative, often costing 30-50% less than new equipment. This trend is particularly pronounced in smaller healthcare facilities that may lack the financial resources to invest in brand-new technology. As a result, the refurbished medical-devices market is experiencing a surge in interest, as these devices provide essential functionality at a fraction of the cost, thereby enabling healthcare providers to allocate resources more efficiently.

Technological Integration and Compatibility

The rapid pace of technological advancements in medical devices necessitates compatibility with existing systems, which is a key driver for the refurbished medical-devices market. Many healthcare facilities in Japan are upgrading their infrastructure, and refurbished devices that can seamlessly integrate with new technologies are in high demand. This trend is particularly relevant as hospitals seek to enhance operational efficiency and improve patient outcomes. The refurbished medical-devices market is positioned to capitalize on this need, as these devices often come equipped with updated software and features that align with current technological standards, making them attractive options for healthcare providers.

Sustainability and Environmental Considerations

Sustainability has become a focal point in Japan's healthcare sector, influencing purchasing decisions in the refurbished medical-devices market. The environmental impact of medical waste is significant, and refurbished devices present a solution by extending the lifecycle of existing equipment. This approach aligns with Japan's commitment to reducing waste and promoting eco-friendly practices. The refurbished medical-devices market is likely to benefit from this shift, as healthcare providers increasingly prioritize sustainability in their procurement strategies. Moreover, the government has been encouraging initiatives that support recycling and refurbishment, further bolstering the market's growth potential.