Rising Healthcare Costs

The escalating costs associated with healthcare in the UK are compelling healthcare providers to seek cost-effective solutions. The refurbished medical-devices market appears to be a viable alternative, as it offers significant savings compared to new equipment. Reports indicate that hospitals can save up to 50% on capital expenditures by opting for refurbished devices. This trend is particularly pronounced in the context of budget constraints faced by the National Health Service (NHS). As the demand for high-quality medical equipment continues to rise, the refurbished medical-devices market is likely to experience increased adoption, driven by the need for financial prudence in healthcare spending.

Technological Advancements

Advancements in technology are playing a pivotal role in shaping the refurbished medical-devices market. Innovations in refurbishment processes and quality assurance are enhancing the reliability and performance of refurbished devices. For instance, the integration of advanced diagnostic tools and software updates ensures that refurbished equipment meets contemporary standards. This evolution not only boosts consumer confidence but also expands the market's appeal to healthcare facilities that require up-to-date technology without the associated costs of new devices. As a result, the refurbished medical-devices market is positioned to grow as healthcare providers increasingly recognize the value of technologically advanced refurbished options.

Environmental Considerations

Environmental sustainability is becoming increasingly important in the UK, influencing various sectors, including healthcare. The refurbished medical-devices market aligns with these environmental goals by promoting the reuse of medical equipment, thereby reducing waste. The practice of refurbishing devices minimizes the carbon footprint associated with manufacturing new equipment. As healthcare organizations strive to meet sustainability targets, the refurbished medical-devices market is likely to benefit from this shift in focus. The potential for reduced environmental impact may encourage more healthcare providers to consider refurbished options as part of their procurement strategies.

Increased Demand for Medical Equipment

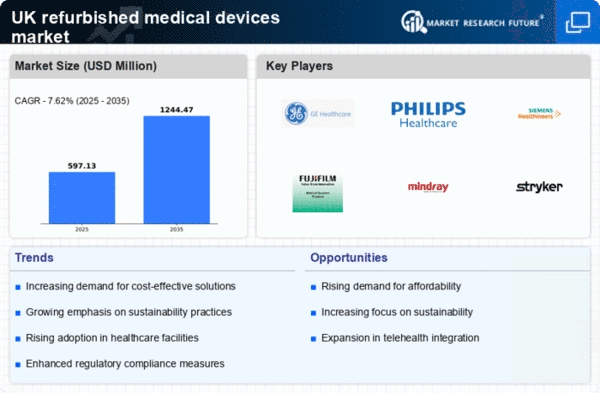

The growing demand for medical equipment in the UK is a significant driver for the refurbished medical-devices market. With an aging population and rising incidences of chronic diseases, healthcare facilities are under pressure to expand their capabilities. The refurbished medical-devices market offers a solution by providing access to a wider range of equipment at lower costs. Data suggests that the market for refurbished devices could grow by approximately 15% annually as healthcare providers seek to meet the increasing demand without overspending. This trend indicates a robust future for the refurbished medical-devices market as it aligns with the evolving needs of the healthcare sector.

Regulatory Support for Refurbished Devices

Regulatory frameworks in the UK are evolving to support the refurbishment of medical devices, which is a crucial driver for the market. The introduction of clearer guidelines and standards for refurbished equipment enhances safety and efficacy, fostering greater acceptance among healthcare providers. Regulatory bodies are increasingly recognizing the importance of refurbished devices in addressing healthcare needs while ensuring compliance with safety standards. This regulatory support is likely to bolster the refurbished medical-devices market, as it reassures stakeholders about the quality and reliability of refurbished products, ultimately leading to increased market penetration.