Infrastructure Development

The expansion of charging infrastructure is a vital driver for the electric vehicles-battery market in South Korea. As the number of electric vehicles on the road increases, the demand for accessible and efficient charging stations is also rising. The government and private sector are collaborating to enhance the charging network, with plans to install thousands of new charging points across urban and rural areas. This development is expected to alleviate range anxiety among potential electric vehicle buyers, thereby stimulating market growth. The electric vehicles-battery market could see a substantial increase in adoption rates as infrastructure improves, potentially leading to a 40% rise in electric vehicle sales by 2030.

Rising Environmental Concerns

The electric vehicles-battery market is experiencing a surge in demand driven by increasing environmental awareness among consumers in South Korea. As climate change becomes a pressing issue, individuals and organizations are seeking sustainable alternatives to traditional vehicles. This shift is reflected in the growing sales of electric vehicles, which have seen a rise of approximately 30% in the last year alone. The South Korean government has also been proactive in promoting eco-friendly transportation solutions, further bolstering the electric vehicles-battery market. The emphasis on reducing carbon footprints and enhancing air quality is likely to continue influencing consumer preferences, thereby expanding the market for electric vehicle batteries.

Advancements in Battery Technology

Innovations in battery technology are playing a crucial role in shaping the electric vehicles-battery market. South Korea is home to several leading battery manufacturers that are investing heavily in research and development. Recent advancements, such as solid-state batteries and improved lithium-ion technologies, are enhancing battery efficiency and longevity. These innovations are expected to reduce costs and increase the range of electric vehicles, making them more appealing to consumers. The market is projected to grow by 25% over the next five years, driven by these technological improvements. As battery performance continues to evolve, the electric vehicles-battery market is likely to witness significant expansion.

Government Support and Regulations

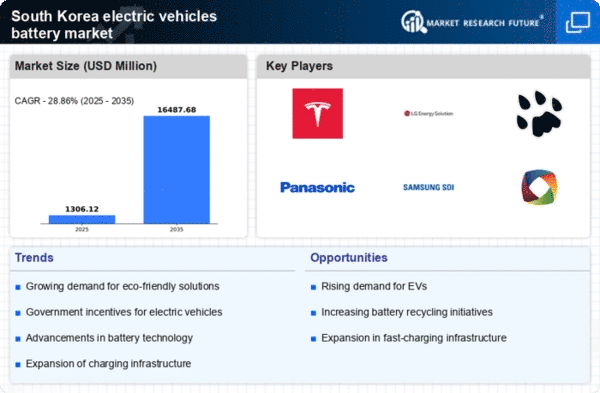

The electric vehicles-battery market is significantly influenced by government support and regulatory frameworks in South Korea. The government has implemented various policies aimed at promoting electric vehicle adoption, including subsidies and tax incentives for consumers. Additionally, regulations mandating emissions reductions are pushing manufacturers to invest in electric vehicle technologies. As a result, the market is expected to grow at a compound annual growth rate (CAGR) of around 20% over the next few years. This supportive environment is likely to attract further investments in the electric vehicles-battery market, fostering innovation and competition among manufacturers.

Economic Factors and Market Dynamics

Economic conditions and market dynamics are pivotal in shaping the electric vehicles-battery market. In South Korea, the increasing cost of fossil fuels and the volatility of oil prices are prompting consumers to consider electric vehicles as a more economical alternative. Additionally, the total cost of ownership for electric vehicles is becoming more competitive, with lower maintenance and fuel costs. The electric vehicles-battery market is likely to benefit from these economic shifts, as consumers seek cost-effective solutions. Analysts predict that the market could expand by 15% annually as economic factors continue to favor electric vehicle adoption.