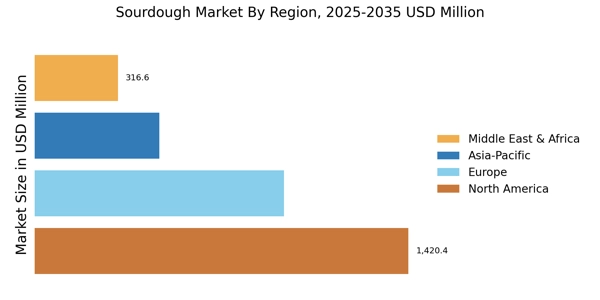

By Region, the study segments the market into North America, Europe, Asia Pacific, and the Rest of the World. Europe's Sourdough Market accounts for the largest market share 41.70% in 2022 and is expected to exhibit a 9.95% CAGR due to the increasing demand for bakery products. The North America sourdough industry is experiencing significant growth and transformation, driven by evolving consumer preferences. Us Sourdough Market analysis reveals that the region has a strong future ahead in this market. As a key player in the global Sourdough industry, Europe has witnessed a surge in the production and consumption of various sourdough products.

Further, the UK market of Sourdough Market held the largest market share, and as well as UK Sourdough industry was the fastest-growing market in the Europe region.

Further, the major countries studied are The U.S., Canada, Mexico, Germany, the UK, Italy, Spain, China, Japan, India, and Australia & New Zealand.

Figure 3: SOURDOUGH MARKET SHARE BY REGION 2022 (%)

The Europe sourdough market has flourished against the backdrop of a rich and diverse culinary heritage, where bread is not just a staple but a cultural emblem. Sourdough Market, with its ancient roots and distinctive tangy flavor, has made its place in the European market. Italy Sourdough Market which is fueling resurgence in ancient grain use and a high demand for premium, digestible bakery products. . The Sourdough market is characterized by a profound appreciation for traditional baking methods, and artisanal bakeries across the continent have played an important role in shaping the sourdough landscape. These bakeries, often rooted in centuries-old techniques, offer an array of sourdough products ranging from rustic loaves to regional specialties, reflecting the varied tastes of European consumers.

The European sourdough industry is marked by its emphasis on quality ingredients, fermentation expertise, and a commitment to preserving the authenticity of time-honored recipes. The resurgence of interest in artisanal and craft-inspired foods has propelled sourdough into the limelight, with consumers seeking the unique taste, texture, and nutritional benefits associated with naturally fermented bread. This trend is not limited to traditional sourdough strongholds like France and Germany; it spans across the continent, with a resurgence of interest in sourdough in countries like the United Kingdom, and Italy.

The Europe market of sourdough comprised Germany, UK, France, Spain, Italy & Rest of Europe, among which the UK emerged as the frontrunner with a market share of 31.75% in 2022.

The North America market of Sourdough Market is expected to grow at a CAGR of 11.04% from 2022 to 2032. The North America sourdough market is studied across the U.S., Canada, and Mexico. The North America sourdough industry is expected to grow owing to a growing consumer preference for artisanal and flavorful bread options. Sourdough Market, with its distinctive tangy taste and textured crust, has emerged as a staple in the region's culinary landscape. This rise is fueled by a broader cultural shift toward traditional and craft-inspired foods, as consumers seek products with authentic flavors and natural fermentation processes.

The market is characterized by a diverse range of sourdough products, including classic loaves, specialty rolls, bagels, and even innovative twists like sourdough-based pastries and crackers. The North America market of sourdough is witnessing an infusion of creativity, with bakers experimenting with diverse flour blends, seeds, and nuts, and even incorporating ancient grains to craft unique and health-conscious sourdough options.

Gluten-free sourdough has also gained traction, catering to the dietary preferences of a broader consumer base. Moreover, the US sourdough industry held the largest market share, and as well as US sourdough industry was the fastest-growing market in the North America region.

The Asia-Pacific Sourdough Market is a dynamic and growing sector, The region is studied across China, India, Japan, Australia & New Zealand, and the Rest of Asia-Pacific. Sourdough Market, with its roots deeply embedded in Western baking traditions, has made significant inroads into the Asian-Pacific market, captivating the palates of consumers who appreciate the nuances of naturally fermented bread. Growing interest in gut health among the aging population has made the Japan sourdough market a key area for functional food innovation. The market is characterized by a blend of traditional craftsmanship and innovative adaptations, reflecting the region's culinary diversity. Malaysia sourdough market is another important part of APAC region.

While rice and rice-based flours have been staples in many Asian countries, the incorporation of sourdough techniques into these traditional grains has resulted in unique and flavorful bread offerings that cater to both local tastes and the global demand for artisanal and specialty products.

Artisanal bakeries and boutique cafes are expected to boost the growth of the Asia-Pacific sourdough, infusing the bread scene with creativity and a commitment to quality. These establishments, often characterized by a fusion of traditional European techniques and local influences, produce a range of sourdough products that go beyond the classic loaf. Sourdough Market buns, flatbreads, and even desserts featuring sourdough discard are gaining popularity, reflecting the adaptability and versatility of this fermentation method within the region's diverse culinary traditions.