Focus on Enhanced User Experience

The Smart Ticketing Market is increasingly focusing on enhancing user experience. As competition among transport providers intensifies, the need to attract and retain customers becomes paramount. Smart ticketing solutions offer features such as real-time updates, personalized travel information, and user-friendly interfaces, which significantly improve the overall customer journey. Data indicates that transport operators implementing smart ticketing systems have reported a 30% increase in customer satisfaction rates. This emphasis on user experience not only fosters loyalty among existing customers but also attracts new users, thereby driving growth in the smart ticketing sector.

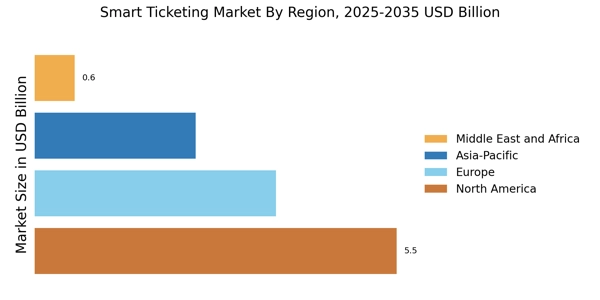

Government Initiatives and Investments

Government initiatives play a pivotal role in shaping the Smart Ticketing Market. Various governments are increasingly investing in modernizing public transport infrastructure, which includes the implementation of smart ticketing systems. For instance, several countries have allocated significant budgets to enhance urban mobility solutions, with some reports indicating that investments in smart transport solutions could exceed 15 billion dollars by 2025. These initiatives not only aim to improve operational efficiency but also to promote sustainable transport options, thereby encouraging the adoption of smart ticketing solutions across various regions.

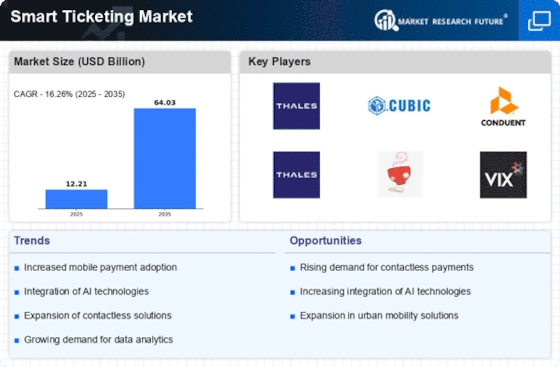

Rising Demand for Contactless Solutions

The Smart Ticketing Market is experiencing a notable surge in demand for contactless solutions. This trend is primarily driven by the increasing consumer preference for seamless and hygienic payment methods. As urban populations grow, the need for efficient public transport systems becomes more pressing. According to recent data, the contactless payment segment is projected to account for a substantial share of the Smart Ticketing Market, with estimates suggesting it could reach a valuation of over 10 billion dollars by 2026. This shift towards contactless technology not only enhances user experience but also streamlines operations for transport authorities, thereby fostering a more efficient ticketing ecosystem.

Technological Advancements in Payment Systems

Technological advancements are significantly influencing the Smart Ticketing Market. Innovations in payment systems, such as the integration of blockchain technology and mobile wallets, are enhancing the security and efficiency of ticketing processes. The rise of digital payment platforms has led to a more streamlined user experience, with data suggesting that mobile wallet transactions in the transport sector could surpass 20 billion dollars by 2025. These advancements not only facilitate faster transactions but also provide valuable data analytics for transport operators, enabling them to optimize services and improve customer satisfaction.

Growing Urbanization and Public Transport Needs

The Smart Ticketing Market is being propelled by the rapid pace of urbanization. As cities expand, the demand for efficient public transport systems intensifies. This urban growth necessitates the implementation of smart ticketing solutions to manage increased passenger volumes effectively. Recent statistics indicate that urban areas are expected to house over 68% of the global population by 2050, which underscores the urgent need for innovative ticketing systems. Smart ticketing not only addresses the challenges posed by urban congestion but also enhances the overall travel experience for commuters, making it a crucial component of modern urban transport strategies.