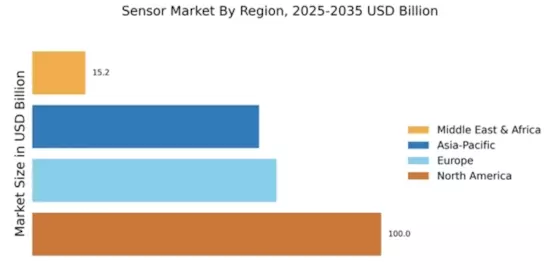

North America : High Capital and Research Costs

The sensor market in North America is supported by a robust industrial base and extensive use of Industry 4.0 and IoT designs, resulting in demand across major verticals. In the automotive sector, that means xEV / BEV or ADAS (advanced driving assistance systems) sensors must be reliable in extreme environments to assist in energy management, real-time system diagnostics, and precise localization. Similarly, the telecommunications carriers deploying 5G technology, are deploying sensor modules associated with network nodes; sensors provide increased efficiency, resilient networks, and the ability to monitor condition-based maintenance of equipment while increasing useful equipment life. Discrete and process manufacturing using predictive maintenance frameworks, and in-line quality inspection can introduce multimodal sensor networks (optical, thermal, active and passive sound, and force) to detect anomalies, eliminate unplanned downtime, and maximize throughput. And smart grid implementations will employ distributed sensing platforms for granular monitoring and automated control of energy flows for enhanced utilization of renewable generation assets. Company funding for sensor R&D is strong, and generally corporate capabilities are vertically integrated - meaning that reliable information from outside sources are limited to a trusted few and organic supply. The production of sensor component parts is equally supported by rigorous quality assurance requirements, improving the grading of sensor components regarding accuracy, robustness, and scalability.

Europe : The Clean Energy and Health‐Technology Sectors

There is considerable vertical integration in markets for automobiles, health care, clean energy and industrial manufacturing which is driving growth in the sensor market throughout Europe. In the automobile space, advanced sensing technologies that include air-quality detection units and LiDAR- and radar-enabled advanced driver assistance systems (ADAS) and environmental monitoring sensors are entering the market align with regulatory mandates related to vehicle emissions and passive safety. In countries such as Germany, France, and the United Kingdom, manufacturers are embracing sensor technology for manufacturing optimization, minimizing downtime, and enhancing supply chain visibility. /Scenarios for application include extracting real-time data to perform predictive diagnostics. Cross-European collaborative R&D alliances and technical standards can also harness and accelerate the application of sensor technology, promote interoperability, and create economies of scale.

Asia-Pacific : Electric and Autonomous Vehicle Production

Following rapid urbanization, industrial digitization, and high levels of technological adoption, Asia-Pacific is the largest and fastest growing market for sensor technologies. The biggest manufacturing centers China, Japan, South Korea, and India are already adopting advanced sensor-based automation systems, such as those found in smart factories, to optimize production processes, quality, and output. Speed of scale is evident for sensor-based automation in manufacturing in the context of Industry 4.0 frameworks and lean production practices. Simultaneously, government backing for large-scale IoT and smart city focus provides the vitally important components of regulatory backing, funding mechanisms, and infrastructure requirements for environmental monitoring, traffic management, and public safety sensor networks. Regionally, while growth appears strong, impeded levels of technology adoption across markets could arise from variable levels of infrastructure maturity, which may affect supply chain resiliency.

Middle East and Africa : Limited Regional Manufacturing Presence

The sensor industry in the Middle East and Africa is continuously evolving because of numerous energy sector initiatives, urbanization, and large infrastructure projects. The demand is coming from traditional sectors like oil and gas, and new renewable sectors like solar and wind, for sensors that enable monitoring, flow control, safety, and optimizing performance. As it pertains to smart cities, especially in the GCC countries, there is notable investment into smart environmental monitoring sensors, smart surveillance sensors, and smart transportation sensors that are key in helping manage urban land space and deliver public services. Local smart city pilot programs should incorporate sensor networks waterfall style, as should large scale energy and infrastructure projects, which indicates the region is ready to embrace sensor networks and new sensing technologies, despite the rigorous regulatory environment and climatic conditions.