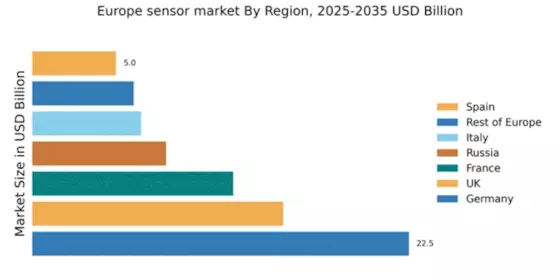

Germany : Innovation and Demand Drive Growth

Germany holds a commanding 22.5% market share in the European sensor market, valued at approximately €3.5 billion. Key growth drivers include a robust automotive sector, increasing automation in manufacturing, and a strong push towards Industry 4.0. Government initiatives promoting smart technologies and sustainability are also pivotal. The country’s advanced infrastructure supports high demand for sensors in various applications, including automotive, industrial, and healthcare.

UK : Strong Demand from Diverse Sectors

Key markets include London, Manchester, and Birmingham, where tech hubs are thriving. The competitive landscape features major players like Honeywell and Texas Instruments, alongside numerous startups. The business environment is favorable, with strong support for innovation and collaboration across sectors, particularly in automotive and healthcare applications.

France : Innovation and Regulation Shape Landscape

Key markets include Paris, Lyon, and Toulouse, which are hubs for aerospace and automotive industries. Major players like STMicroelectronics and Infineon Technologies have a strong presence, contributing to a competitive landscape. The local market dynamics favor innovation, with a focus on applications in transportation, healthcare, and smart cities.

Russia : Industrial Growth Fuels Demand

Key markets include Moscow and St. Petersburg, where industrial activities are concentrated. The competitive landscape features both local and international players, with companies like Honeywell and Siemens establishing a foothold. The business environment is evolving, with a growing emphasis on digital transformation and smart technologies across various industries.

Italy : Diverse Industries Drive Market

Key markets include Milan, Turin, and Bologna, which are centers for automotive and manufacturing industries. The competitive landscape features major players like Bosch Sensortec and STMicroelectronics. The local market dynamics are favorable, with a strong focus on R&D and collaboration between industry and academia, particularly in automotive and industrial applications.

Spain : Innovation in Smart Technologies

Key markets include Madrid and Barcelona, where technology and innovation are thriving. The competitive landscape features both local and international players, with companies like Texas Instruments and Omron making significant contributions. The business environment is supportive of innovation, with a focus on applications in smart cities and renewable energy.

Rest of Europe : Varied Applications Across Regions

Key markets include cities across Scandinavia, Eastern Europe, and the Benelux region. The competitive landscape features a mix of local and international players, with significant contributions from companies like NXP Semiconductors and Analog Devices. The local market dynamics are characterized by a focus on innovation and collaboration, particularly in sectors like healthcare and smart technologies.